Starting with the US: The Fed’s double‐edged sword (Interest rate)

Starting with the US: The Fed’s double‐edged sword (Interest rate)

Over the past year, the Fed has raised the benchmark rate 9 times for a total of 4.75%, the fastest pace of tightening since early 1980. The fight to control inflation has moved to achieving balance between inflation, growth and employment. A new risk of banking emerged in the form of failure of SVB. Interest rate and value of bond assets have an inverse relation. Failure of effective Asset Liability management saw the value of a SVB bond asset sale worth $21 billion fall by $1.8 billion. While the Fed took quick actions to rescue the financial system, this has hastened the need to address the inverted yield curve and the temporary pause in rate hike.

The Consumer Price Index (CPI) rose 0.1% in March and 5% from a year ago, but below estimates. Excluding food and energy, core CPI accelerated 0.4% and 5.6% respectively. Energy costs fell and food prices were flat. A 0.6% increase in shelter costs was the smallest gain since November, but still resulted in prices rising 8.2% on an annual basis. Shelter makes up about one‐third of the weight in the CPI and excluding shelter, the CPI rose 3.4% from a year ago. Used vehicle prices, a major contributor to the initial inflation surge in 2021, declined 0.9% in March and are now down 11.2% year over year. March PPI inflation hit 2.7% (below expectations of 3.0%). Core PPI inflation came in at 3.4%, in‐line with expectations. PPI inflation fell from 4.9% to 2.7% in 1 month, the largest monthly drop since inflation peaked in 2022. March unemployment rate edged down to 3.5%, against expectations that it would hold at 3.6%. The number of unemployed people decreased by 97,000 to 5.839 million and employment levels rose by 577,000 to 160.892 million.

Our year end thesis of “good is bad and bad is good” has played out in this quarter. Stocks surged out of the gate in January, hoping that inflationary pressures would subside, and the Federal Reserve would stop their rate increases. Economic data in February came in hotter than expected, which dashed hopes that the Fed would pause its rate hike cycle and pressured stocks in the middle of the quarter. In the weeks after SVB and Signature Bank collapse, both bonds and stocks rallied again.

Europe: Members in dilemma

The Euro Area saw a quarterly growth rate of 0.7%, an improvement from the stagnant GDP in the previous quarter. Annual inflation rate in the Euro Area was at 6.9% in March 2023, down for a 5th consecutive month from last October’s record high of 10.6% and its lowest level since February 2022. Still, the rate remained stubbornly high and well above the European Central Bank’s target of 2.0%, putting pressure on policymakers to push on with further rate hikes. The ECB raised interest rates by 50 bps as expected in March, further pushing borrowing costs to the highest level since late 2008. Interest rate on the main refinancing operations and rates on the marginal lending facility and the deposit facility were increased to 3.50%, 3.75% and 3.00%, respectively. The yield on the UK’s 10‐year Gilt extended to 3.9% in April, its highest level since March as stronger‐than‐ expected inflation and wage data supported expectations for a rate hike at the BoE meeting in May.

Energy prices dropped 0.9 percent in March, the first month of decline in two years, while non‐energy industrial goods inflation eased to 6.6 percent from 6.8 percent in February. The euro held above the $1.09 mark, close to an over‐12‐month high of $1.1075 as European Central Bank policymakers called for a tighter policy.

China: Backloading of economic activity

Last year, GDP expanded by just 3%, as China’s approach to control the coronavirus hurt supply chains and hammered consumer spending. China’s economy got off to a solid start in 2023, as consumers went on a spending spree after three years of strict pandemic restrictions ended. GDP grew by 4.5% in the first quarter from a year ago. In the January to March months, retail sales grew 5.8%, mainly lifted by a surge in revenue from the catering service industry. Industrial production also showed a steady increase

‐ up 3.9% in March, compared with 2.4% in the January to February period.

Foreign direct investment into China increased 4.9% from a year earlier to CNY 408.45 billion in the first three months of 2023. FDI inflows into high‐tech industries surged 18 percent, particularly electronics and communications equipment manufacturing. The International Monetary Fund in its World Economic Outlook said China is “rebounding strongly” following the reopening of its economy and that China GDP will grow 5.2% this year and 5.1% in 2024.

On the flip side, the all‐important real estate sector remains mired in a deep downturn. Investment in property declined 5.8% in the first quarter and property sales (by floor area) decreased by 1.8%. Fixed asset investment by the private sector increased 0.6% from January to March, indicating a lack of confidence among entrepreneurs. This was worse than the 0.8% growth recorded in the January‐to‐ February period. Youth unemployment has surged to the second highest level on record and the jobless rate for 16‐ to 24‐year‐olds hit 19.6% in March, up for a third straight month.

India: Optimism on its peak

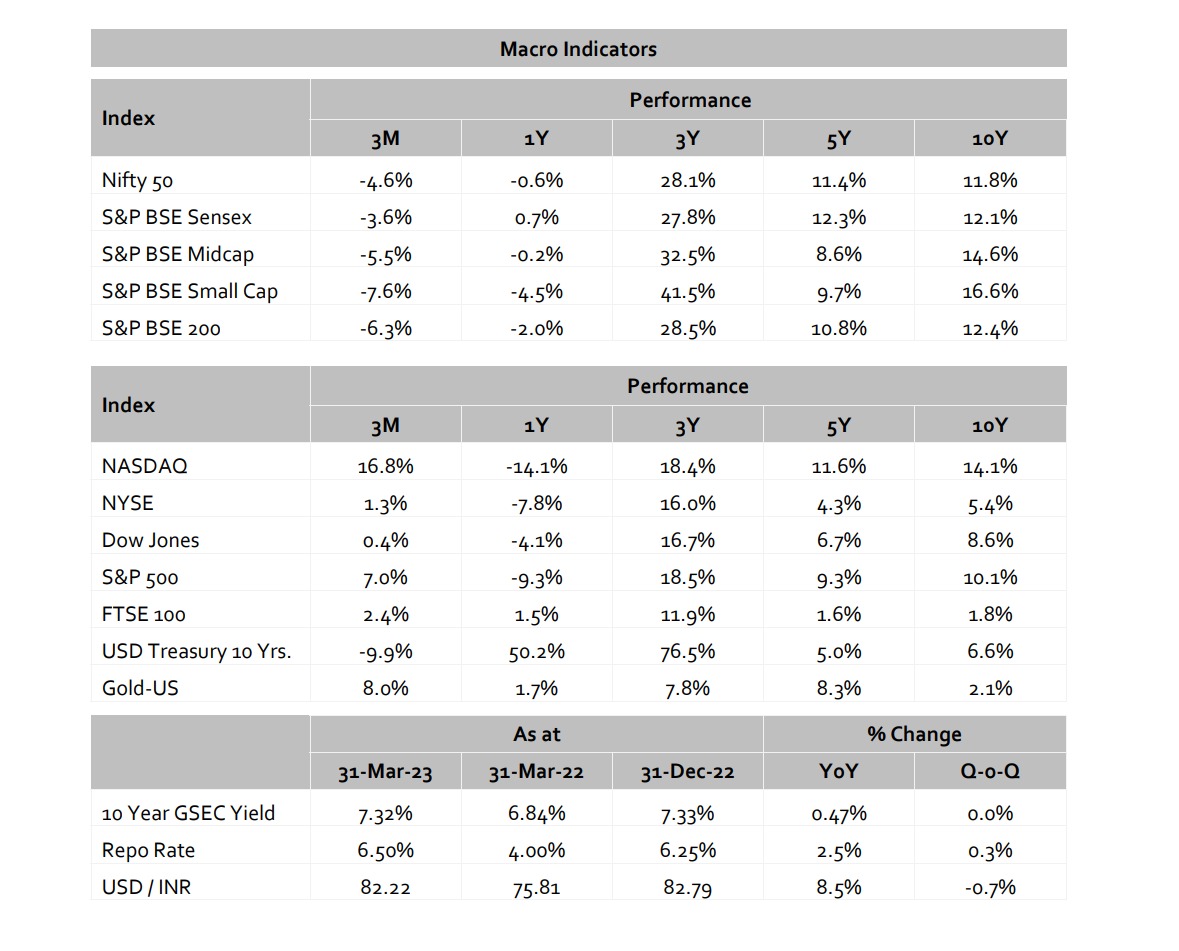

The last quarter of FY 2023 was a roller coaster largely led by the Adani fiasco in the start and the regional banking collapse in the US at the end. Indian markets tanked after Hindenburg Research came out with a report accusing the Adani conglomerate of fraud. Nifty50 ended 4% down this quarter, however some stability in the global markets and a surprise move by the Reserve Bank of India to pause interest rate hikes this month brought a relief rally in the market post year‐end. RBI has marginally raised growth projection for FY24 to 6.5 % from an earlier estimate of 6.4 % and inflation to drop to 5.2 % for FY24 and 5.1 % for first quarter FY24.

The Asian Development Bank (ADB) projects growth of India’s GDP to 6.7% in FY2024, driven by private consumption and private investment on the back of government policies to improve transport infrastructure, logistics, and the business ecosystem. The private sector balance sheet has improved over the past couple of years, implying private sector is poised to increase spending, which can boost capex as and when the investment cycle picks up. Besides, corporate deleveraging has improved bank’s balance sheets, hence, Indian bank’s asset quality has been improved. Improving labour market conditions and consumer confidence will drive growth in private consumption. The central government’s commitment to significantly increase capital expenditure in FY2023, despite targeting a lower fiscal deficit of 5.9% of GDP, will also spur demand

India remains a key beneficiary from falling oil prices. The ripple effects of lower commodity prices are likely to help sooth inflation in the latter half of the year. From an earnings standpoint, analysts expect the base effects to kick in the next few quarters. Similar trends are visible in high frequency numbers. Credit growth which is currently trending at 15‐16% could also see some degree of moderation. During such phases, competitive intensity returns as companies fight for growth and the winners are often, market leaders and disruptors.

Our in‐house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries