A Multi Family office

Bespoke solutions to Families, Institutions and Individuals in India and Globally

About Valtrust

Our clients entrust us to manage their investments across a range of asset classes, which include Equities, Debt and Alternates.

READ MORE

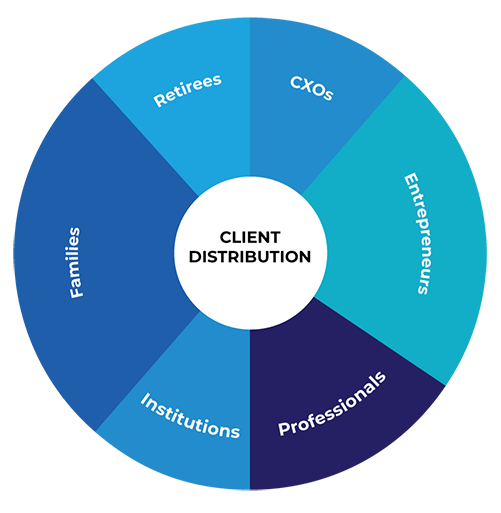

Our Clients

Track Record

4

50+

MEDIA

2025: Q3 Macro Review

Q1 2025 saw sharp divergence in global equities. US markets faltered due to trade tensions, inflation worries, and tech sector shifts, posting their worst quarter...

2025: Q2 Macro Review

Q1 2025 saw sharp divergence in global equities. US markets faltered due to trade tensions, inflation worries, and tech sector shifts, posting their worst quarter...

2025: Q1 Macro Review

Q1 2025 saw sharp divergence in global equities. US markets faltered due to trade tensions, inflation worries, and tech sector shifts, posting their worst quarter...

SUBSCRIBE

Stay Updated

Scan this QR code using the WhatsApp camera to join this community

- Latest trends in the Stock Market

- Exclusive in-depth Financial Insights

- Local & Global Investment Opportunities

Corporate Address:

Valtrust Capital Private Limited

WorkEz, RK Swamy Centre, 1st Floor,

Block B, Door No 3/147

Thousand Lights, Pathari Road,

Chennai – 600006