A quarter which started with US debt ceiling concerns has witnessed the US Congress approve legislation that effectively suspends the debt ceiling. Central banks

A quarter which started with US debt ceiling concerns has witnessed the US Congress approve legislation that effectively suspends the debt ceiling. Central banks

across the globe raised interest rates and the US Fed elected to stay on hold. While inflation is to be controlled, steps are being taken to avoid (or atleast delay) a global

recession – there is also a significant drop in bond market volatility. Driven by this mindset global shares rallied led by developed markets, notably the US. Tech participants

have benefitted the most with enthusiasm over AI (Artificial Intelligence)

Starting with the US: A hawkish Fed with a pause on rate hikes

The US Treasury Department reached its debt ceiling of $31.4 trillion in January 2023, and after months of debate, lawmakers voted in June to suspend the ceiling until January 2025. The U.S. Congress has raised the debt ceiling 78 times since 1960. The U.S. economy grew at a 2% (revised) annualized pace in the first quarter,

which was well above the previous estimate of 1.3% and the 1.4% Dow Jones consensus forecast. The Federal Reserve raised interest rates by 25 basis points in May. However, it did not hike rates in June, adopting what economists have termed a “hawkish pause”. Annual inflation rate in the US slowed to 3% in June of 2023, marking a 12th consecutive month of falls and the lowest reading since March of 2021. It compares with 4% in May and forecasts of 3.1%. Core inflation rate

dropped to 4.8%, the lowest since October of 2021.The slowdown is partly due to a high base effect from last year when a surge in energy and food prices pushed the headline inflation rate to 1981-highs of 9.1%. In June, energy cost slumped 16.7%, prices of used vehicle declined 5.2%. New home sale rose by 12.2% in May, Durable

goods sale grew by 1.7% beating the expectation of 0.9%, keeping consumer confidence high at end of the quarter to 109.7 vs 102.5 in May. The unemployment rate in the US decreased slightly to 3.6% in June 2023, which is lower than May’s seven-month high of 3.7% and in line with market expectations. The number of unemployed people decreased by 140 thousand to 5.96 million and employment levels rose by 273 thousand to 160.99 million. US equities ended the quarter higher, with bulk of the gains made in June. The advance came amid moderating inflation and signs that the US economy remains resilient despite higher interest rates. Fervour around AI and the potential for a boom in related technology drove chipmakers and the IT sector higher. Consumer discretionary and communication services sectors also performed strongly. Inflation is being tamed and a remarkably resilient labour market has increased expectations of a soft landing. The Fed will not fight Real rates, and while Real rates are elevated, they are showing signs of softening.

Europe: A relentless ECB continues to hike rates.

The European Central Bank (ECB) raised interest rates twice in the quarter by 25 basis point each. Interest rates on the main refinancing operations, rates on the marginal lending facility and deposit facility were increased to 4.00%, 4.25% and 3.50% respectively. The covid era APP (Asset purchase programme) is declining at a measured and predictable pace, as the Euro-system does not reinvest all the principal payments from maturing securities. The decline will amount to €15 billion per month on average until the end of June 2023 post which reinvestments under the APP will be discontinued as of July 2023. Consumer price inflation in the Euro Area decreased to 5.5% in June 2023, slightly below market expectations of 5.6%. While the rate hit its lowest level since January 2022, it remained significantly above the European Central Bank’s target of 2.0%. Producer prices in the Euro Area slumped 1.9% month-over-month in May 2023, the fifth consecutive period of decline and compared with market expectations of a 1.8% fall. The drop in prices was primarily driven by a substantial decrease in energy costs. Energy Inflation in the Euro Area decreased by 5.60% in June as compared to a 1.80% decrease in May. The flash eurozone composite purchasing managers’ index (PMI) fell to 50.3 in June from 52.8 in May. That represents a five-month low and suggests the economy may be close to stagnation (50 is the mark that separates expansion from contraction in the PMI surveys).

China: The world factory is losing steam

China’s industrial production advanced by 3.5% year-on-year in May 2023, easing from a 5.6% rise in April and slightly less than forecasts of 3.6%. It was the 13th straight month of growth in industrial output but the softest pace in three months, mainly due to a slowdown in manufacturing activity. Manufacturing PMI rose to 49 in June of 2023 from 48.8 in May, matching market estimates while pointing to the third straight month of contraction in factory activity. Services PMI fell to 53.9 in June 2023 from 57.1 in the previous month. The reading pointed to the sixth straight month of expansion in services activity but the softest pace since January amid moderated demand. China’s post-pandemic recovery is losing steam. Fixed-asset investments grew by 4.0% year-on-year to CNY 18.88 trillion in the first five months of 2023, less than market forecasts of 4.4% and easing from a 4.7% rise in the prior period. Investment in real estate also fell by 7.2%. Trade surplus fell to USD 70.62 billion in June 2023 from USD 97.41 billion in the same period a year earlier and below market forecasts of USD 74.80 billion, as exports dropped more than imports amid persistent weak demand from home and abroad. Exports slumped 12.4% year over year, the second straight month of decline and the steepest drop since February 2020, worse than market consensus of a 9.5% fall, while imports shrank by 6.9%. The politically sensitive trade surplus with the US widened slightly to USD 28.72 billion in June from USD 28.16 billion in May.

India: Breaking the all-time highs.

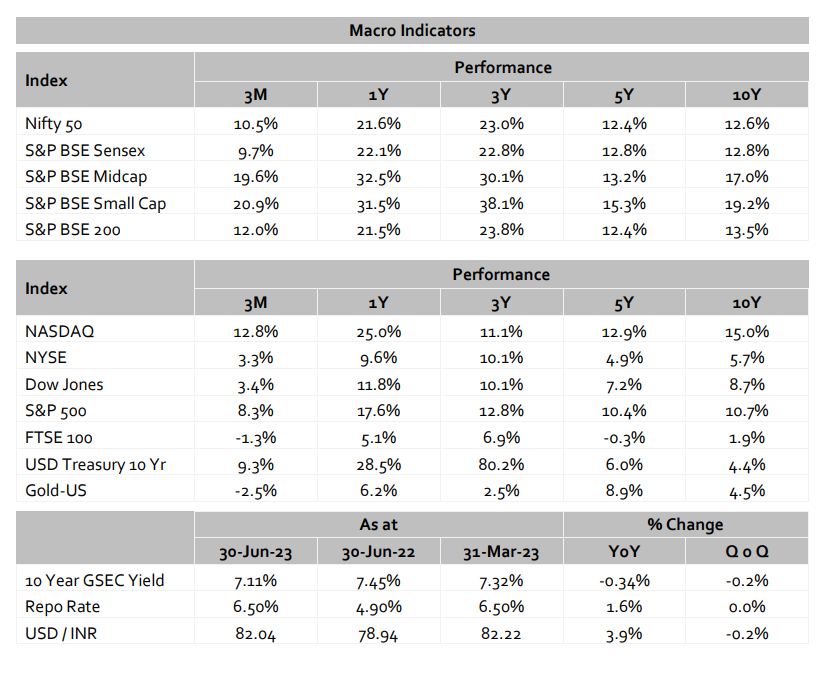

Markets breached an all-time high after a lull of about 1.5 years with major indices gaining around 11% this quarter. Whilst valuations are not cheap, they aren’t expensive either. Corporate earnings have grown at decent pace and hold great prospects. First few months of 2023 saw China delivering extraordinary growth and FIIs piled into China’s stock markets, often at the cost of Indian equities. This period of first four months saw massive FIIs outflows from Indian equities, and consequently, Indian indices corrected by up to 10 percent. However, the optimism around China’s recovery was short-lived. Within a few months, pent-up demand started losing steam and in response, FIIs backtracked, and came flooding back into Indian equities and bought around $6.7 billion in June itself. Additionally, the rupee received a boost from significant foreign capital inflows. While global recessionary conditions have cast a dark cloud on Indian exports, there is a silver lining on the horizon. Several bilateral and multilateral trade agreements are either in place or underway with UAE, UK, USA etc. which are expected to help India’s trade recover over the long term. According to a recent report by Morgan

Stanley, MNC sentiment is observed at a multiyear high on India and that keep India one of the most promising investment destinations. We remain constructive on India’s economic outlook. FY24 GDP growth is expected to be 5.8% with a CPI inflation of 5%. Annual consumer inflation rate accelerated for the first time in five months to 4.81% in June from an upwardly revised 4.31% in May, led by rising food prices, while core inflation moderated marginally. Favourable base effects will remain in play in Q2 FY24 but will continue to fade. The RBI did not raise interest rate in the last meeting and is likely maintain status quo for the rest of FY24 as interest rates have appear to have peaked.

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries