After gains in the first half of 2023, the third quarter saw both equities and bonds posting a negative return. The risk of global interest rates remaining elevated for a longer period remains a key risk. The expected “soft landing” for the US may well turn into a recession. The macro risk of an elongated global slowdown has gained steam and US, Europe and Asian markets all saw cuts.

After gains in the first half of 2023, the third quarter saw both equities and bonds posting a negative return. The risk of global interest rates remaining elevated for a longer period remains a key risk. The expected “soft landing” for the US may well turn into a recession. The macro risk of an elongated global slowdown has gained steam and US, Europe and Asian markets all saw cuts.

The only outperformer was commodities with energy gaining amidst oil production cuts from Saudi Arabia and Russia. On the flip side, elevated energy prices do not help governments in their goal of taming inflation.

Starting with the US: No way out of increased government spending Investors entered the quarter optimistic that the Federal Reserve (“Fed”) had orchestrated a soft landing for the economy and that the era of policy tightening rates would end soon. However, the Fed raised rates by 25bps in July and signalled there could be another hike this year. The Fed chose not to raise interest rates at its September meeting and left the Federal funds policy rate at 5.25% to 5.50%. The FOMC’s economic projections now show the median expectation for GDP growth this year at 2.1% (previously 1.1%) and next year at 1.5% (previously 1.0%). The Fed has made it clear that the economy has proven to be stronger than expected because of the ongoing strength of the consumer and believes the trade-off between growth and inflation has also improved. Annual core consumer price inflation fell to 4.1% in September, the lowest since September 2021. However, the monthly CPI rose by 0.4% from a month earlier. Producer price inflation accelerated to 2.2% year on year in September. Composite purchasing manager’s index (PMI) fell marginally to 50.1 in September, down from 50.2 in August, emphasising the US economy is cooling. On the flip side, the US labour market remains very strong. The unemployment rate was at 3.8% in September 2023 slightly above market expectations of 3.7%. The labour force participation rate was also unchanged at 62.8%, the highest since February 2020. US equities remained weak in the third quarter amidst the worries of the negative effects of interest rate rises on economic growth. Technology was under pressure along with the less influential sectors of real estate and utilities. While there has been much enthusiasm this year around the long-term potential of artificial intelligence, nearer-term concerns over consumer spending are also affecting demand for chips. Energy stocks were relatively resilient over the quarter, and one of few bright spots in a quarter notching up gains amid higher oil prices as some oil exporting countries cut production. The most critical risk facing the US today is the ever-increasing deficit. With the ongoing war in Ukraine and now a potentially expensive Middle East conflict there is little light at the end of the tunnel. The current deficit is just under 6% of GDP and if defence spending increases this could crawl to up to 8% of GDP i.e. unchecked government spending is slowly becoming the next major threat to the US economy.

Europe: Inflation may finally be coming under check

The ECB hiked interest rates for the 10th consecutive time in September and signalled to keep tightening policy, as inflation has started to decline but is still expected to remain too high for too long. Consequently, the main refinancing operations rate reached a 22-year high of 4.5%, and the deposit facility rate set a record at 4%. Average inflation is forecasted to be at 5.6% in 2023 and 3.2% in 2024 (higher than previous estimates),primarily due to an elevated energy price. The central bank has also significantly reduced its GDP growth projections, now anticipating the economy to expand by 0.7% in 2023 and 1.0% in 2024. Annual core inflation rate in the Euro Area decreased to 4.5% in September, the lowest since August last year. Data released at the very end of the period showed Eurozone inflation slowed to a two-year low of 4.3% in the year to September, down from 5.2% in August. This could potentially pave the way for the European Central Bank to put an end to interest rate rises. PMI data showed that the Eurozone private sector was in contraction, although the composite reading edged up to 47.2 in September from 46.7 in August. There were also concerns about China’s growth following shrinking factory activity, suggesting that demand for Europe’s exports would remain weak. Manufacturing PMI was lower at 43.4 in September from the previous month’s 43.5. This figure signalled the 15th successive month of contraction in the industry sector, new order inflows dropped, and output levels shrank at a faster rate. Eurozone shares fell in the quarter with FTSE Europe down by -5.5%. Some of the steepest declines came in the consumer discretionary sector given concerns over the knock-on effects of higher interest rates on consumers’ disposable income. Other sectors to outperform included financials, where quarterly results from the banks continued to show the benefit of rising rates on their top lines.

China: Real estate woes

The IMF raised concerns about China’s financial stability due to an escalating real estate crisis, signalling a downward revision of the country’s growth forecasts. China’s top 100 real-estate developers recorded total sales of $47.1 billion in August, down 34% from the monthly total a year earlier, marking the lowest monthly total in recent years. Home prices are falling, developers are defaulting, local governments have huge revenue shortfalls and consequently, commercial banks and bondholders are facing massive write-offs. Composite PMI fell to 50.9 in September 2023 from 51.7 in August. This was the 9th straight month of slowing growth in private sector activity since January as new orders rose at a softer pace with manufacturers and service providers recording only marginal increases in sales. Manufacturing PMI declined to 50.6 in September from August’s 6-month high of 51.0 and below market estimates of 51.2. Fixed-asset investment grew by 3.2% in the first 8 months of 2023, compared with market forecasts of 3.3%. The Chinese market experienced sharp declines in the quarter, as the problems in the property sector resurfaced and limited policy stimulus has been announced to address the issue. MSCI China was down 4.6% during the quarter.

India: A significant Debt market too, for the world

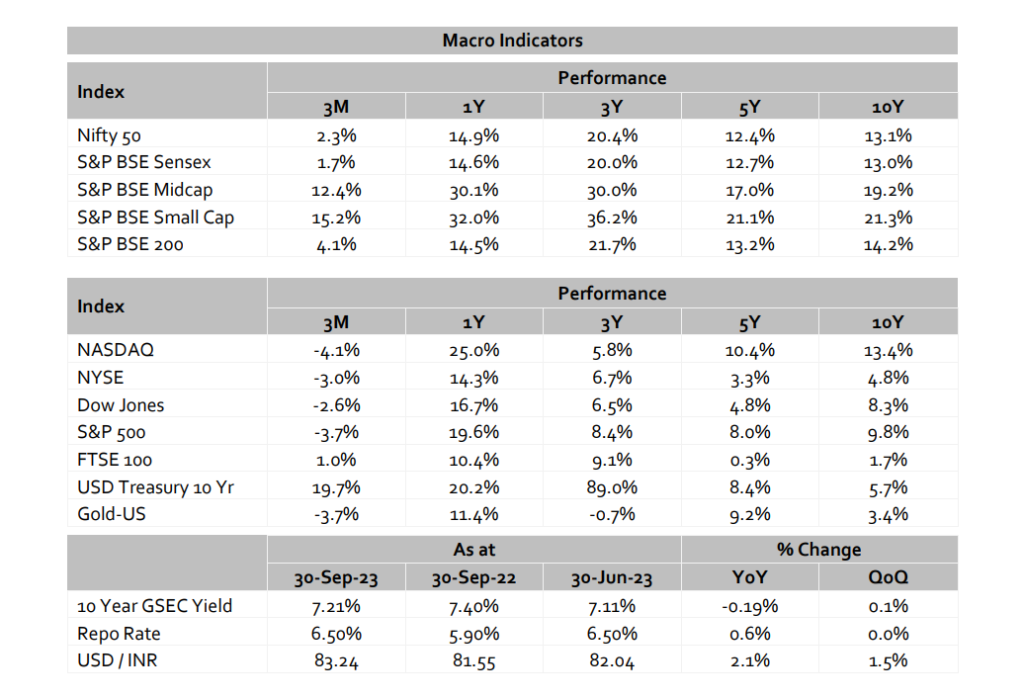

Indian Equities outperformed the world as major indices remained positive and resilient amidst the pessimism and uncertainty when the US and the entire world (MSCI world index down -3.5%) ended in negative territory this quarter. Mid and small-cap index breached all-time highs with 12% and 15% gains respectively. The debt market also started getting attention from the world’s big financial institutions as JPMorgan announced the inclusion of India in its widely tracked emerging market debt index. This inclusion potentially sets the stage fora potential $ 30bn billions of dollars of inflows into the Indian economy that could help to finance the current account and fiscal deficits. The Reserve Bank of India kept its benchmark policy repo at 6.5% for the fourth consecutive meeting in October 2023, in line with market expectations. Policymakers said the decision remains to align inflation to the RBI’s tolerance range of 4% ± 2% while supporting economic growth. The central bank maintained its economic growth and headline inflation forecast for the fiscal year 2024 at 6.5% and 5.4%, respectively, while softening its core inflation forecast by 140 bps to 4.9%. Credit is growing at a fast pace as the value of loans increased 20% yearly.

Retail inflation dropped to 5.02% year-on-year in September 2023, down from 6.83% in the previous month and well below the market consensus of 5.5%, primarily due to a significant slowdown in food inflation. Services PMI increased to 61.0 in September from 60.1 in August, signalling a sharp upturn in output that was one of he strongest in over 13 years. New business increased to the second-fastest since June 2010, with export order growth being one of the fastest seen since September 2014 despite slowing to a three-month low. Composite PMI inched up to 61.0 in September 2023 from 60.9 in the prior month, indicating one of the highest readings in 13 years. The latest figure also marked the 26th straight month of expansion in private sector activity, supported by buoyant demand in both manufacturing and service economies. Unemployment rate decreased to 7.10% in September from 8.10% in August of 2023. Overall, most data show a structurally improving economy.

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries