While the last quarter of 2021 witnessed a new, and subsequently raging Omicron variant, the biggest threat to the global economy was not covid, but rising inflation. The key drivers for inflation have been (1) Rising energy prices; (2) Global trade supply chain bottlenecks; and (3) Quantitive Easing (QE) alongside low and negative rates.

While the last 2 years have witnessed a tremendous accelaration in adoption of technology, they have also resulted in hugely indebted governments. The over-arching macro concern for 2022 will be the impact any deleveraging exercise will have on prices of asset classes.

Starting with the US: Inflation rise at fastest rate in nearly 40 years.

The Atlanta Fed has revised down 4th quarter GDP estimates from 6.8% to 5%. This is predominantly driven by a more than expcted fall in december retail sales of 1.9% (expected 0.1% fall) with 10 out of 13 sectors showing a drop. Excluding gas and energy (which went up due to price increases) the fall is closer to 2.5%. On a positive note the unemployment rate was at a 22-month low of 3.9%. The employment report painted a picture of an economy that closed 2021 on a high note, with a record 6.4 million jobs created in 2021. This was the largest annual increase in employment since record-keeping started in 1939.

December’s marked the third month in a row of US annual inflation hovering above 6% – well north of policymakers’ 2% target. Price increases were seen across many sectors, including gas, food and housing. The Consumer Price Index (CPI) inflation is at an annual pace of 7% while the Producer Price Index (PPI) inflation is at 9.7%. With energy prices continuing to rise and ever increasing supply chain bottlenecks, the fear is that inflation is becoming more structural – the outlook for January is not comforting.

On the back of rising inflation and a massive federal budget deficit (c. USD 30 trillion), the US Fed announced that the central bank will accelerate the pace of tapering asset purchases and prepare for raising interest rates in 2022. A $30 billion further reduction in asset purchases is expected starting January 2022 with a target of ending asset purchases by March 2022. The next step would be to consider raising interest rates with 0.75 to 1% hike expected over 3 – 4 rate hikes. The positive in all this is that the Fed seems to be more clear with the timelines. Following the announcement on the shrinking of Fed’s balancesheet along with the rising interest rates, the 10-year traded at 1.7%, near its two-year high mark and the 2-year rate jumped by 5 basis points to 0.82%. Rising interest rates impact cylical sectors/stocks (read real estate and financials).

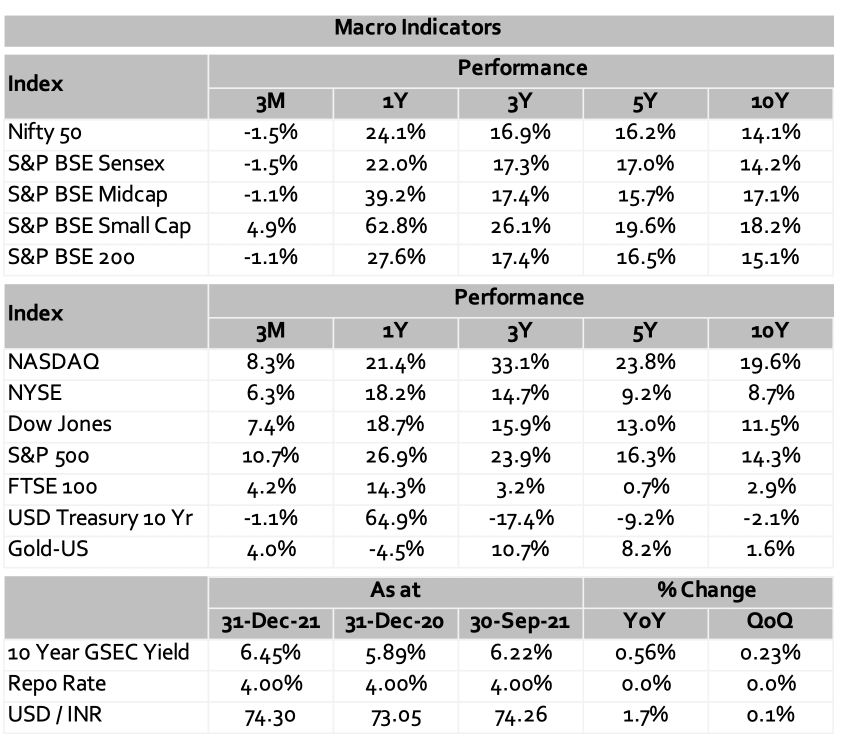

Wrapping up FY 2021 the S&P 500 rose c. 26% while the Dow and Nasdaq gained c. 18 % and c. 21% respectively – three strong years in the running. Within the S&P, energy stocks investors turned out to be winning the league (energy demaned surged as economies reopened) while Technology was at the fourth place. Strong corporate earnings were a key driver with estimated yoy earnings growth rate for 2021 at 45.1% (according to FactSet).

Europe: PEPP going down while APP ramping up

Europe has been hit hard by covid in this quarter. The headline IHS Markit Eurozone Composite PMI® dropped from 55.4 in November to 53.4 in December- an easing in the rate of output growth to the lowest since March. The decline takes average reading for the quarter to 54.3, substantially lower than the 58.4 average seen in the third quarter. While the PMI data points to a marked weakening of economic growth, the rate of growth still remains above the survey’s pre-pandemic long-run average of 53.0.

The December slowdown was led by the service sector, where business activity grew at the weakest rate since April. The fall in tourism and recreation activity is of a similar magnitude to the declines seen at the start of the year amid rising COVID-19 infection rates and restrictions across the region. Manufacturing output growth meanwhile picked up with the factory sector outpacing services for the first time in five months (still well below rates of expansion seen earlier in the year). Despite manufacturers reporting a weakening of new order growth, December saw the largest expansion of production since September due to easing of supply constraints.

Since March 2020, the European Central Bank (ECB) has been buying bonds under its 1.85 trillion euros ($2.19 trillion) Pandemic Emergency Purchase Programme (PEPP). PEPP is due to end in March 2022. Bond buys under the Asset Purchase Programme (APP) will be ramped up to serve as a quantitative easing bridge through the end of the PEPP, having continued at a monthly pace of 20 billion euros in conjunction with the PEPP until now. The euro gained 0.5% against the dollar following the decision, to trade at around $1.134. German 10-year bund yields have climbed to -0.3220%.

China: Increasing tech clampdown and ongoing property woes

China’s Consumer Price Index (CPI) was up by 1.5% in December (compared to a year ago / lower than the expected 1.8%) but still a drop from the 2.3% increase in November. The official manufacturing Purchasing Managers’ Index (PMI) rose to 50.3 from 50.1 in November (exceeding analysts’ estimates of 50.0). Economic headwinds in the near term are expected, primarily due to a slowing manufacturing sector, debt problems in the property market, carbon emissions-related curbs, and small-scale COVID-19 outbreaks.

The major technological backlash of the last quarter has left investors guessing as to what is the overarching reason for the measures taken. China’s anti-monopoly rules and regulators’ concerns about data privacy as well as web security may lead to more divestment in the country’s Internet space in the coming months. Evergrande is struggling to repay more than $300 billion in liabilities, including nearly $20 billion of offshore bonds deemed in cross-default by ratings agencies after it missed payments. Chinese property developer Shimao Group Holdings’ debt troubles have deepened concerns over the property market and potential spillover of the cash crunch. As much as one third of China’s developers may see their liquidity “acutely strained” while defaults are set to rise as $84bn of debt matures over the next five quarters.

Q4 GDP grew 4% from a year ago (the weakest expansion in 1.5 years) with full year 2021 growth at 8.1%. The Chinese economy is likely to slow down more than people expect as the highly transmissible Omicron is a difficulty for China zero covid strategy.

Closer home in India: Ends the year on a flatish note

Equity markets had a flatish close this quarter, with Nifty falling 1.5%. 2021 was a roller coaster ride driven by global tailwinds and rising favour for the India growth story. Amidst turbulence in the rest of the emerging markets, India stood out as a favoured destination for global investors, with Nifty rising 24% for the full year.

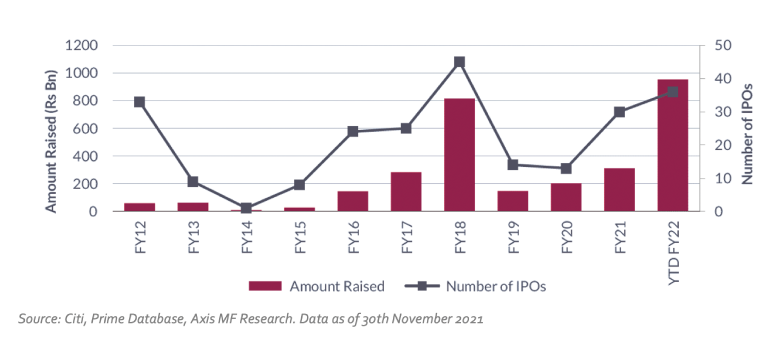

2021 was a year of IPOs – marquee unlisted names saw successful listings and venture capitalists made strong exits underscoring the potential in this space.

GDP for full year should be upwards of 9% in real terms and trend for next year too would be c. 6%. The economy is expected to continue with recovery momentum and become broad-based. Government spend provides the enabling lever, further high vaccination rates and higher consumption will drive the overall recovery. India is on the verge of a strong capex led growth acceleration, helped by a multitude of factors including a supportive domestic policy environment, delevered corporate balance sheets and a strong commodity cycle. The key risk is that in the near term, the rapid spread of Omicron can worsen lockdowns, supply bottlenecks, inflation and hence there could be sharper liquidity withdrawal by central banks.

Inflation may surprise on the upside and remain outside of the RBI’s projections in the near term. 2022 average inflation may reverse the declining trend and inch higher to 5.4% -5.6% on the back of elevated core inflation and as manufacturers pass on higher input cost with demand recovery. While interest rates have bottomed out, liquidity normalization is likely to be bigger policy focus.

Markets expect rate hikes in 2022 following the footsteps of US Fed. A pointer to this is the increase in the 10 year G Sec to 6.5% from 5.8% levels in the beginning of 2021. Overall, India is likely to continue to deliver on earnings growth but markets may remain volatile largely due to fund flows.

—————————————————————————————————————————————————————————————————————————————————————————————-

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/

—————————————————————————————————————————————————————————————————————————————————————————————