We end 2022 as a year where the value of all asset classes: equities, debt, real estate, crypto etc. have witnessed major corrections. Unwinding of liquidity and increase in the cost of capital have taken their toll.

The last quarter can best be described as “good is bad” i.e. while economic data is good, interest rates will continue to rise, which adversly effects value of all asset classes. The mantra for 2023 may well be “bad is good” – weak economic data will bring an end to rate hikes and the associated fall in asset prices…as long as there is no prolonged recession.

Starting with the US: Journey from Peak to Trough

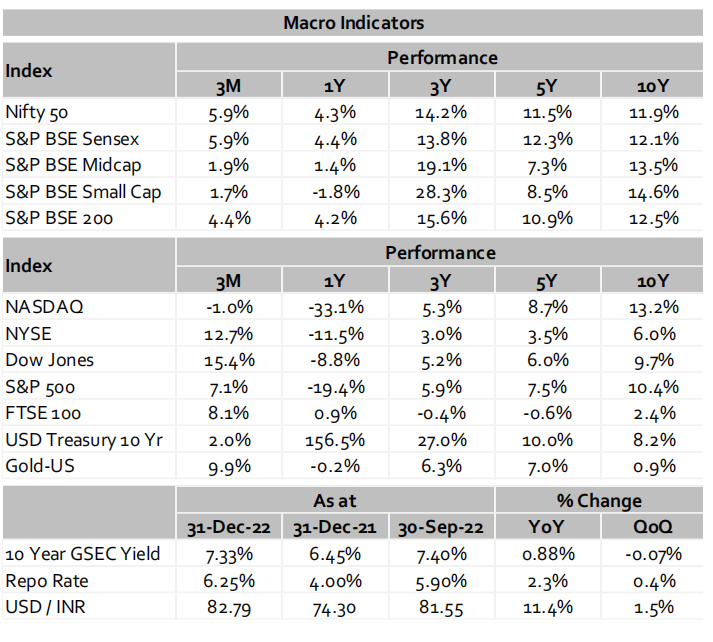

The Fed increased interest rates by 125 bps in Q4. In the December FOMC, the Fed reaffirmed its stance on rising interest rates as it increased its projection of key rates from 4.6% to 5.1%. The impact of yields on market sentiment is so strong that on days when yields rise equity values fall and a correction in yields results in a bounce back in equities. The S&P 500 has rallied by 6% or more 4 times this year and then made fresh lows on the long term outlook of the Fed.

US trade deficit narrowed to $61.5Bn in November – the lowest since September’20. Government Debt as a percentage of GDP stood at 120% at the end of Q3, still close to the news headlines of Q4:21. The Energy sector major contributor to rising global inflation saw a decline as Energy Inflation reduced to 7.3% in December (compared to 13.1% in November).

The slowdown in the US economy is now showing. The Composite Purchasing Managers Index which includes manufacturing and services contracted from 46.4 in November to 45.0 in December. The Consumer Price Index (CPI) from its peak in June at 9.1% declined in November to 7.1% and further in December to 6.5%. Consumer prices declined by 0.1% MoM for December and core CPI slowed 0.3% MoM and 5.7% YoY in December from

6% in November. Notwithstanding the slowdown, the US remains the most resilient among developed markets as GDP grew by 3.2% in Q3 (coming out from a contraction of 0.6% in the Q2). December data confirms the unemployment rate edging down to 3.5% compared to 3.7% in November. Non-farm payrolls data increased by 223,000 (above Dow Jones estimate of 200,000) although still below the November data of 256,000. Wage growth showed signs of slowdown with average hourly earnings up 4.6%, the lowest since August 2021.

2022 has been the worst year for US Equity markets since 2008. Both Equity and Bonds posted an annual decline for the first time since 1960s even though the year started with US equity indices hitting all-time highs. The tech heavy Nasdaq 100 was dealt the short hand the of the stick and was down 33% in 2022. Looking deeper into fixed income markets, long duration bonds outperformed short duration bonds. The longer duration 10 Yr.

US T-Note stood at 3.88% yield compared to 1 Yr. T-Bill at a yield of 4.73% – yield curve inversion is one of the

key indicators of recession.

As global equity markets weakened, Bitcoin and other major cryptocurrencies finished off a disastrous 2022 on a quiet note in December, marked by low volatility and little price movement in the crypto market. Markets continue to follow the drama surrounding the collapse of crypto exchange FTX.

Europe: Battles on all fronts

The ECB raised Eurozone key rates by 75 bps in November which was highest rate hike since 1989, followed by 50 Bps rate hike in December and hinted on increasing rates for a long duration. The cumulative 125 bps hike helped save the Euro which had hit parity with the dollar. Inflation in Europe soared with data in October of 10.7%. It came down to 10.1% in November and expectation is that inflation will come back to single digits’ in December. Core CPI, which excludes food and energy price stood at 5.2% in December compared to 5.0% both in October and November. Availability of Gas and its high prices is a key issue European governments must solve – Europe in Q2’22 spent €75B on energy supplies which on YoY basis was a jump of 282% and was close to the record amount of €76B in Q1’22. Deadlines for Green transition also present a unique conundrum.

2023 saw European markets witnessing turbulence. 2 years of covid pandemic and the ongoing Russia-Ukraine war resulted in soaring inflation and high energy prices – crushing blows to an economy which was already weak. Change in governments across countries including Germany, Italy and UK have only added to the mess. The UK has one of the biggest bond market in the world – this came to a near collapse when the former prime minister of UK proposed tax cuts. The BoE in an unprecedented move bought £19.3Bn of bonds to restore the market. UK is spiralling in wage growth problems which are still above the trend lines but steps to reduce them are inducing worker strikes all over UK.

China: Growth in sight after covid flight

China’s economy after contracting sharply in Q2 with growth plunging to 0.4%YoY (the lowest in two years) grew by 3.9%YoY in Q3. However, the rebound was well short of the year-end growth target of 5.5%. Consumer Price Index (CPI) increased by 1.8% in December compared with 1.6% in November. The core consumer inflation rate which excludes the prices of food and energy saw a increase of 10 bps in December compared to November. On the negative side, manufacturing and service industries contracted. The Purchasing Managers Composite Index (PMI) which includes both manufacturing and servicing dropped from 49.0 in October to 42.6 in the December. The Chinese apex bank PBOC, contrary to its global counterparts held its 1Yr prime loan rates at 3.65% and 5 Yr PLR at 4.30% for the 4th straight month with cash injections into the economy to incentivise consumers to spend actively to revive growth. With removal of its zero covid policy, rising cases in Q4 pose a threat to any short term economic rebound. From a longer term perspective the Chinese economy will rebound and reduction in travel restrictions will provide an impetus not only to China (in particular the real estate sector), but also to Europe (increased tourism with high spending power).

India: Oasis of 2022

At a time when world market indices remain under pressure and loom to give out positive returns, Indian markets hit an all-time high. Q4 saw a volatile environment for individual stocks while large-cap based broader Indian indices edged up with NIFTY 50 putting out a 5.9% return in Q4 aided by a strong rally of auto and banking stocks compared to the laggard S&P BSE small-cap with 1.7% return. Overall, the strong run can be attributed to a rise in positive net flows of FPIs in H2 FY22 after 9 months of negative flows since October 2021. Indian markets throughout 2022 were spared a deeper correction like global markets as

corporate and financial balance sheets are healthy with the lowest Debt/EBITDA since 2009 and ROE crossing 15% for the first time since 2012. Now as the developed markets await recession, India is witnessing some consolidation but is still better placed as India has many businesses that are domestically driven and less reliance on imports and export could put India in a position of strength coupled with a young working population.

The Reserve Bank of India (RBI) recently hiked the repo rate by 35 bps, the fifth such increase in 2022. The repo rate currently stands at 6.25% closer to the estimated terminal rate of 6.5%. In the latter half of 2022, the RBI withdrew its accommodative stance as it aims to achieve 4% CPI inflation in the medium term. The CPI inflation reading of December came in at 5.7% better than the expectations of 5.9% and for the first time in 40 years was below the CPI inflation of the US. As the dollar comes off its highs of September, we might also see INR appreciation with Indian yields easing off and US yields edging up in consensus with uncovered interest parity.

As the global growth outlook gets skewed further with monetary policy tightening and crushing financial markets. We remain sanguine about India’s structural growth drivers; the present global macro backdrop can pose headwinds in the near-term domestic growth. India has been a beneficiary of excess global liquidity, higher metal and commodity prices and strong industrial demand in the post-Covid recovery phase, visible through the above trend growth in exports during the past 2-3 years. As global economies have been attempting to engineer a slowdown to control inflation and we finally see the effects receding with commodity prices falling and lowering Inflation, India’s set to expand with near-term consolidation.

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/