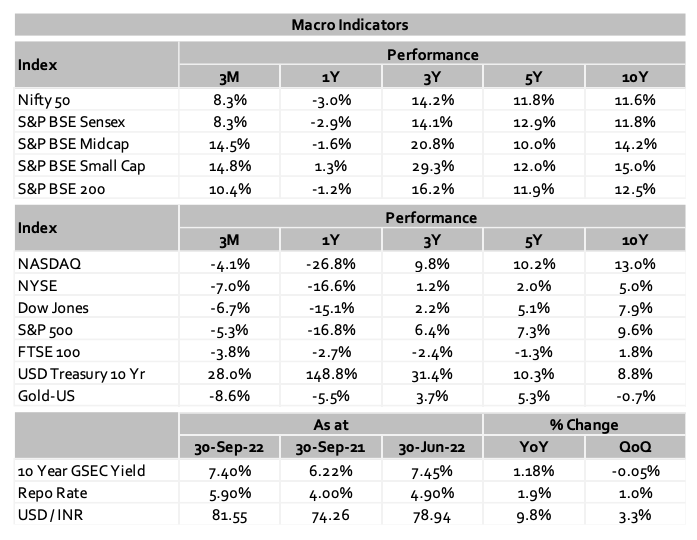

After a July rally which was largely driven by resilient corporate earnings, the rest of the quarter was gloomy with most asset classes (including bonds and stocks) giving negative returns. Regulators across the globe joined a belligerent US Federal Reserve (Fed) in raising rates to fight inflation. With the Fed leading this charge, the US dollar strengthened against all global currencies. Weakened currencies, high interest rates, and uncertainty around energy (availability and price) have cemented the fears about a global recession.

Starting with the US: Inflation has peaked, but still choking markets

The Fed increased interest rates by 150 bps in Q3, technically putting the United States into a recession. In the September FOMC, the Fed reaffirmed its bullish stance on interest rates and US bond yields touched all-time highs with yields hovering around 4%. The impact of yields on market sentiment is so strong that on days when yields rise equity values fall and a correction in yields results in a bounce back in equities. While the strategy of buying dips might have helped traders, long-term investors have experienced much pain with the S&P 500 rallying by 6% or more four times this year and then making fresh lows after each instance.

While rising rates are paving the way for a global recession, the US economy remains the most resilient of all developed markets. The US Consumer Price Index (CPI) showed signs of peaking in June at 9.1% and subsequently declined in July (8.5%) and August (8.3%). Consumer prices rose by 0.4% for September 2022 (up 8.2% for the 12 month period) while core CPI accelerated 0.6% and 6.6% respectively. US non-farm payroll increased by 263,000 in September and has averaged around 420,000 monthly in 2022. September unemployment rate edged down to 3.5% (same as in July) and was down from 3.7% in August.

US trade deficit decreased by 4.4% in August compared to July while Government Debt as percentage of GDP stood at 122% at the end of Q2 which was the headline of Q4:21. Energy sector, which is a major contributor to the rising inflation globally saw a decline as Energy Inflation reduced to 19.8% in September compared to 23.5% in August. Real Gross Domestic Product (GDP) decreased at an annual rate of 0.6% in Q2 compared to 1.6% decline in Q1 which can be attributed to increased consumer spending which rose by 1.2% in June. The Purchasing Managers Index showed expansion in manufacturing activity as it increased to 52 in September compared to 51.5 in August.

As global equity markets weakened, crypto markets showed signs of revival where the total market cap of cryptocurrency increased by 8.5%.The number of nonfungible token (NFT) trades increased by 11% from the second quarter of 2022 while Ethereum’s NFT trading volume was down by a large margin of 76%. Crypto remains a high-risk asset class for investors with a high-risk appetite.

Europe: Recession a baseline scenario

European markets have been in turmoil since the start of the Russia-Ukraine war. The downside scenario projection of contraction in growth is turning out to be the baseline scenario for policymakers across Europe. Governments across Europe have stepped in to counter the rise in consumer prices but most strategies have shown little effect. Inflation in Europe has been consecutively breaking records as it climbed up to 9.9% in September compared to 9.1% in August. Core CPI, which excludes food and energy price stood at 4.8% in September compared to 4.3% in August. Availability of and high gas prices is a key issue European governments must solve – Europe last year imported $100B of energy which accounted for 70% of its energy requirements. Deadlines for Green transition also present a unique conundrum. An economic region which had barely started recovering from the impact of Covid is facing major challenges. The S&P500 September PMI reading of 48.4 is indicative of a contraction in manufacturing.

Stocks and Bonds have both delivered negative returns in Q3, with Europe s’ largest bond market coming to a near collapse after proposals fortax cuts were introduced in the UK parliament. Credit Suisse, one of the largest banks in Europe is being tagged as another Lehman with its falling stock price and skyrocketing spreads on its CDS. The financial sector of Europe is in dire need of a helping hand and the interesting part is that governments of Europe may be dependent on the direction of the US Fed for rate hikes.

The ECB is under constant pressure to increase interest to not only fight inflation but also to fortify against a rising dollar. This quarter saw the euro hit parity against the dollar and the outlook is worse given the certainty of recession in 2023. The lax monetary policy of European Governments for over a decade has put Europe in a tough spot as it battles on all fronts.

China: The zero covid policy starting to take a toll

China’s economy after contracting sharply in Q2with growth plunging to 0.4% (the lowest in two years) showed signs of a turnaround. However, the rebound was short of estimates and analysts peg China s’ growth to stay between 3.0%-3.6%, well short of the year-end growth target of 5.5%. A stringent zero-covid and a sluggish housing market present themselves as an important challenge for growth with the majority of analysts attributing growth contraction to the ongoing property crisis.

On the macro front, Consumer Price Index (CPI) increased 3.4% from a year earlier whilst also widening from the 3.1% gain in July. The core consumer inflation rate which excludes the prices of food and energy saw a decline of 0.2% in August compared to July. On the positive side, manufacturing and service industries expanded. The Purchasing Managers Index (PMI) rose to 50.1 in September from 49.4 in the previous month. Domestic consumer demand weakened as imports declined by 0.2% in August but imports of Russian gas and oil surged notwithstanding the embargo placed on Russia. The Chinese apex bank PBOC, contrary to its global counterparts surprised by trimming key interest rates from 4.45% to 4.30% as it wants consumers to spend actively to revive growth in the real estate sector.

India: An outlier in a gloomy world

Equity markets bounced back this quarter with the Nifty 50 posting 8.3% return in Q2 and the Small-cap index bagging 14.8%. Valuations in the last quarter were expected to be corrected and growth was the only way to go in Q3. Even now as India s’ GDP growth forecast has been cut down several times due to spill over effects from war, the Indian stock market has put up a resilient stance this quarter. India has the highest Y-o-Y growth rates and now becomes an interesting place for return seekers as the world slows down. It also opens up a place for the comeback of commodity investors who left India due to its vulnerability to commodity inflation. Indian markets were spared a deeper correction like global markets as corporate and financial balance sheets are healthy with the lowest Debt/EBITDA since 2009 and ROE crossing 15% for the first time since 2012.

The MPC in September voted to hike the repo rate by 50bps to 5.9% in line with consensus. The MPC while wanting to support growth looks like is bound to control inflationary pressures as it withdrew its accommodative stance as it aims to achieve 4% CPI inflation for the medium term. On the growth part India s’ Gross value added (GVA) rose by 12.7% in Q1:22-23, while domestic aggregate expanded on Y-o-Y basis, the drag in exports was a crater on the bright moon. CPI inflation rose 7% (y-o-y) in august from 6.7% in July.

The RBI recently announced measures to attract forex flows through banks, corporates and debt investors signalling a stronger intent in addressing the current dollar shortage and controlling the INR fall against the USD. The INR has depreciated 9% compared to average 15% of G10 countries. A close monitoring of the impact on the forex exchange rate caused by these measures by RBI needs to be monitored. Forex reserves remain at a healthy level but are still down by 21% from their all-time high in October’21.

Whilst we remain sanguine about India’s structural growth drivers, the present global macro backdrop can pose headwinds in the near-term domestic growth. India has been a beneficiary of excess global liquidity, higher metal and commodity prices and strong industrial demand in the post-Covid recovery phase, visible through the above trend growth in exports during the past 2-3 years. As global economies attempt to engineer a slowdown to control inflation, India’s external sector growth can come under pressure even as domestic demand maintains strength.

—————————————————————————————————————————————————————————————————————————————————————————————-

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/