2020 has come to a close. To all our readers we hope you have crossed it without any long-lasting scars. While we begin 2021 with renewed optimism hoping 2021 puts the pandemic behind us, there is also a need for abundant caution.

2020 has come to a close. To all our readers we hope you have crossed it without any long-lasting scars. While we begin 2021 with renewed optimism hoping 2021 puts the pandemic behind us, there is also a need for abundant caution.

Ballooning budget deficits, inflationary pressures and market corrections driven by high valuations make our mantra for the year “don’t chase the market – let it come to you”. So let’s see where we are:

Starting with the US: How long will the stimulus continue?

Election uncertainty is behind us and there is clarity on the next President (it should really not be so complicated). Macro indicators, that proved surprisingly resilient through most of 2020 are beginning to show cracks. On the positive side, the ISM manufacturing index rose from 57.5 in November to 60.7 in December – a sign that manufacturing remains healthy. This was further reconfirmed with seven straight months of increase in factory orders, with the increase for November at 1%. On the flip side, 123,000 private payrolls were lost in December (of which a major part were “service” jobs). Continuing unemployment claims remained elevated at 5.2 million and fall in December retail sales further added to economic woes. The Atlanta Fed lowered its fourth-quarter GDP estimate from 10.4% to 8.6%.

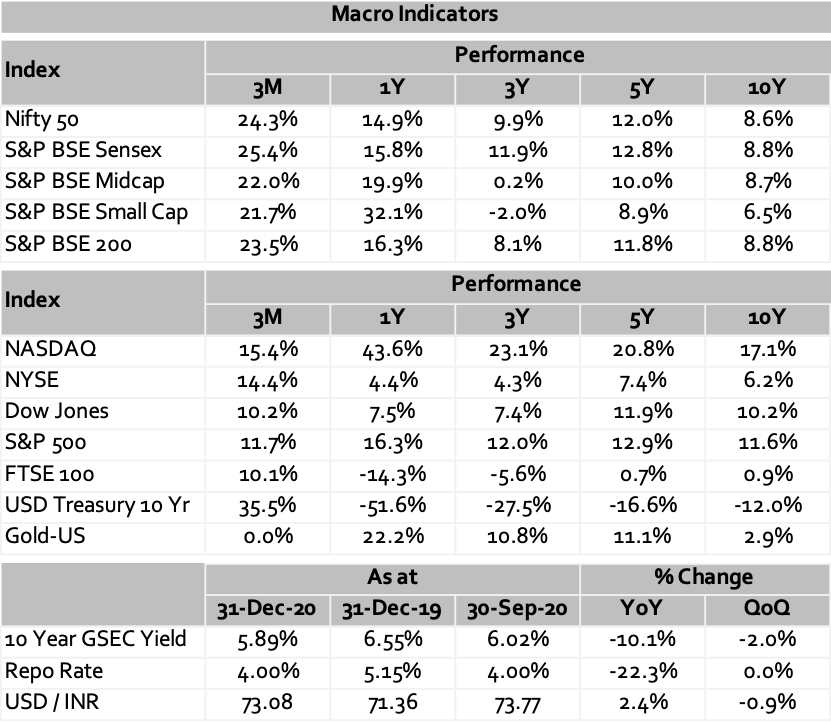

Moving to markets, the 10 year treasury yield increased from 0.9% to 1.1% – it has been a long time since the 10 year yield has exceeded 1%. This is a clear sign that another stimulus package is on the cards – the first from the Biden administration. As per the American Hospital Association herd immunity by the summer requires 1.8mn daily vaccinations for the time period January 1 to May 1. Concerns on rising inflation have abetted with the control of Covid expected to take atleast the first 6 months of 2021. The S&P 500 is trading at a 12-month forward PE ratio of 22 – this is above the 5 year average of 17.5. An upward revision of the $170 forward earnings number would narrow the gap, but it is clear that low yields in the debt side make equities a favourable asset class. While the Fed has announced it will keep rates low till 2024, a correction in markets would also narrow the Forward PE gap. The signs are there – an overbought BMI (Big Money Index) and massive ETF buying is also losing steam.

Massive deficit spending will continue and the anticipated tax hikes would be delayed to end of 2021 or even 2022. Inflation is expected to rear its ugly head only in the second half of the year.. which is good for commodity prices. While quantitative easing affects stock prices, there will be frequent pull-backs from the markets – a strategy entailing “let the market come to you” rather than “reaching out for the market” should be the mantra for 2021.

Europe: The nightmare continues…

A major development was the completion of Brexit… the world is just glad that it is over. New strains quickly decimated hopes of a revival of European economic activity in the last quarter. For 2021 the outlook for inflation is at 1% (compared to 0.2% in 2020) and Real GDP growth at 3.9% (2020 GDP fell a staggering -7.3%). To put in perspective, only by 2023 is Europe GDP expected to go above its 2019 level. The European central bank will have to keep interest rates low and extend its asset purchase program well through most of 2021. The silver lining for Europe is that factories are still open (positioned to benefit as global trade increases) and the construction sector continues to operate in most major economies. Most households have saved unprecedented amounts of money paving the way for a quick rebound in demand and activity – but all this will only happen when new lock-downs are lifted.

China: Back on track..!!

China has been the fastest to control Covid and the macro numbers are reflecting that it is the winner in the lengthy fall out with the US. In December, China reported its largest ever monthly trade surplus at USD 78 billion. Exports grew by 18.1% when compared to a year earlier while imports grew by 6.5% during the same period. China is expected to be the only G20 nation to show a positive economic growth rate in 2020 (forecast at 1.9% by the IMF). The Biden administration will also probably be a lot more friendly.

Closer home in India: Markets close at an all time high; liquidity remains a key risk.

Sensex and Nifty-50 crossed all-time highs in 2020, ending with gains of 15.8% and 14.9%, respectively. The year started on a negative note due to the Covid-19 outbreak, subsequent lockdown and pause in economic activities. The opening of the economy and positive developments on Covid-19 vaccinations boosted investor sentiments in the second half of the year. A quick recap of the key developments of 2020:

- RBI cut the repo rate by 115 bps to 4% during the year;

- FY21 first-quarter GDP growth slipped sharply to (-)23.9%;

- Tensions between India and China over a border dispute;

- The Finance Ministry and RBI announced a slew of measures to fight economic stress; and

- FPIs bought US$23 bn worth of equities while DIIs sold US$4.9 bn.

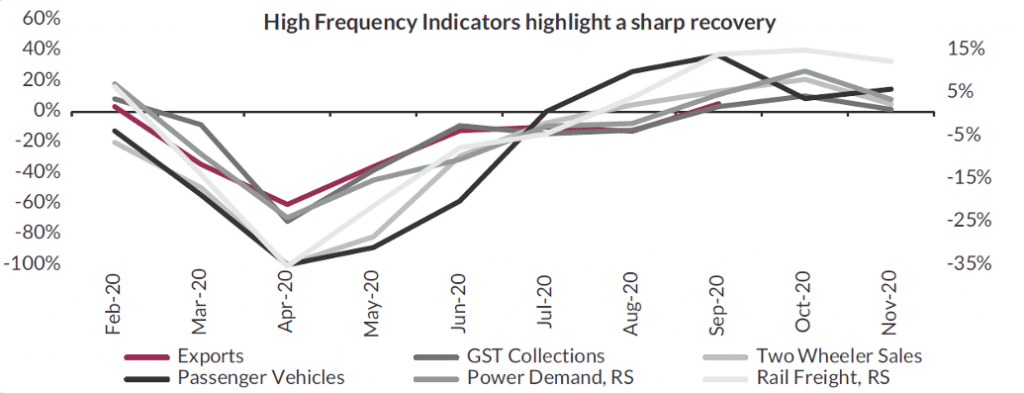

After a tumultuous 2020, 2021 is expected to look markedly different on the growth front. With high-frequency data improving, the economy is expected to reach the pre-pandemic level of output. Analysts remain constructive on the growth trend and expect the recovery to gain strength from Q2 FY21. RBI’s accommodative monetary policy stance will further support the recovery and structural reforms to lift medium-term growth prospects. The growth mix should be relatively more productive capex is expected to pick up – initially by public infra spending, and later by an improvement in private capex.

At ~20x FY22E (which is premised on superlative earnings growth in FY22E), the market does look optically expensive and hence one must remain cognizant of fundamentals. On the other hand, the massively reduced cost of capital has rendered the previous valuation benchmarks meaningless. Continued liquidity could keep the market levels elevated. India remains in sync with the rest of the world with global liquidity remaining a key risk to current valuations.

Domestic bond yields have followed the operative rate downwards as the RBI and the government have emphasised of bringing rates lower through policy action and accommodative monetary policy in an attempt to spur growth. Inflation has surprised on the upside in the last few months but fell massively in December to 4.59%, the lowest since September 2019 (15 months). It is likely to remain near the 4.5% mark for a good part of next year, with core inflation remaining firm as growth recovers. The corporate curve and long-dated government bonds today trade at spreads of over 200 bps over comparable 3 year assets creating significant opportunities for long term investors looking to lock in rates.

——————————————————————————————————————–

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/

——————————————————————————————————————–