Starting with the U.S.: The Fed wants to (and is) keeping control…

The last quarter was all about the Fed QE program, targeted to soften the impact of economic disruptions and to ensure US business would have sufficient liquidity. Closer to the end of the quarter the results started coming in.

U.S. consumer confidence index was 85.9 in May and increased to 98.1 in June – a significant outperformance over the June expectation of 91. Consumer spending accounts for approximately 80% of GDP growth so this is a material positive number. On the home front, contacts to buy homes increased 44% in May (April was a drop of 21%) against expectations of a 15% rise. Low interest rates (a consequence of the Fed QE) have transmitted into low mortgage rates. On the job front, ADP revised its May numbers from a previous loss of 2.7million to an increase of 3.0 million. Further, it reported that 2.3 million private jobs were created in June (overall Labour Department June payroll increase was of 4.8mn / well above the consensus estimate of 2.9 million). The June unemployment rate was at 11.1%, lower than the 13.3% in May. While these numbers are positive expect volatility on this front given resurgence of lock-down restrictions. New jobless claims while declining, continue to surpass consensus estimates.

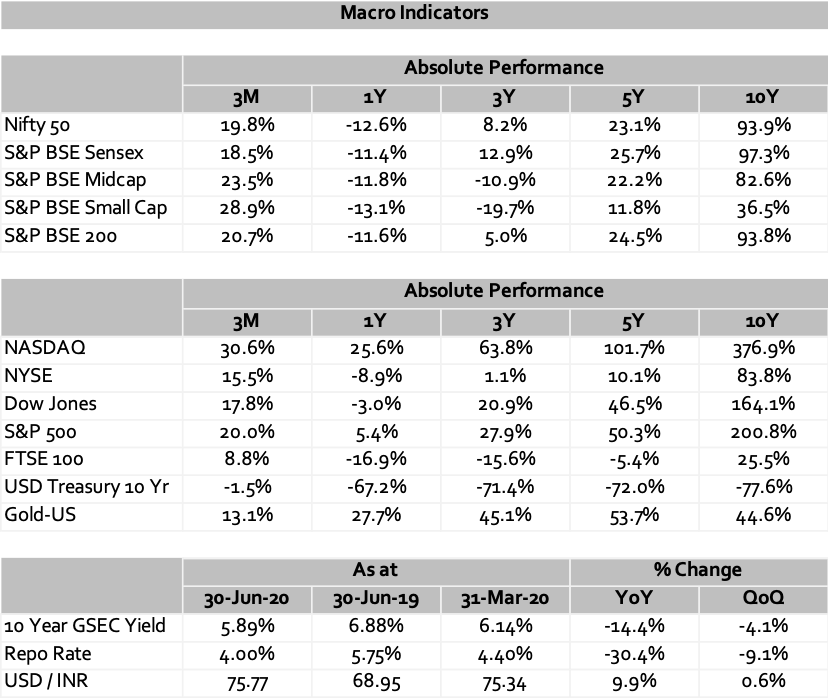

The Fed did a stress test of the major U.S. banks and while all passed, a longer disruption would put the smallest of banks under stress. While the Fed continues to present a picture of high caution, the economic indicators are a lot more positive – clearly drive by the generously accommodative stand of the Fed. The Fed is doing an incredible job controlling Treasury yields – the long term and now even the short term (3year / 5 year). Expect the Federal Open Market Committee (FOMC) to maintain its near-zero interest rate policy for the near future.

Money is flowing into mortgages and also the stock market (the Dow now yields close to 5x the 30-year treasury yield). The debate for economic recovery is moving towards the shape – a “V” or a “U”; the only catch is new lockdowns. Equity investors need to recognise that markets will become narrower and move to companies which deliver consistent quarterly results.

Moving on to Europe: The ECB firepower is resulting in (limited) damage control…

Similar to the Fed, the ECB also threw in substantial firepower last quarter and this quarter started showing some positive results. Global manufacturing based on purchasing managers indices (PMIs) for the Eurozone increased from 33.4 in April to 39.4 in May to 47.4 in June. While the overall increase was driven by an increase in the major economies of Britain, France and Germany, contraction in the Eurozone manufacturing sector continues to remain a major risk.

As per the European Commission, the Eurozone is still expected to contract 8.7% this year with Italy, France and Spain all contracting more than 10%. German industrial production data was weaker than expected and while May witnessed a rise of 7.8%, this was lower than the expected rebound of 10%. Amongst the larger economies, Germany is expected to fare the best with a contraction of 6.3%. The Eurozone will continue to struggle for the rest of the year.

China: Out of the woods…not quite….

China is the first major country to reopen after lifting of restrictions. June official PMI rose to 50.9, up from 50.6 in May. The PMI is now at a three month high and a 50+ reading is a positive expansionary signal. There have been large selloff in Chinese government debt resulting in higher yield on 10-year cash bonds (approx. 2.85%, which was less than 2.6% in April 2020). Trillions of yuan have been injected into the financial system by The People’s Bank of China resulting in multiyear low borrowing costs. Many corporates have taken advantage of this and borrowed cheap and invested in higher-yielding investments. The central bank is taking steps to inject more liquidity into the financial system.

Going forward, the risk to China is more from (short term) economic sanctions and (long term) COVID related backlash – as we get closer to U.S. elections one can expect the sabre rattling to pick up. There is already speculation of the removal of the HKD currency peg (very difficult to execute) and technology companies are talking of restricting services in HK. A Global long term move away from China remains more political posturing and not a real economic threat.

Closer home in India: Gradual unlocking with “Bharat” outperforming “India”

With the lockdown easing in most parts of the country and with restrictions largely on containment zones, the economy is gradually seeing improvement.

Government has been supportive of rural economy and has infused ~INR 1.5trn in the rural economy post-Mar 2020 under various schemes. Moody’s downgraded India’s credit rating to Baa3 from Baa2 and retained the ‘negative’ outlook which was soon followed by Fitch, citing increasing risk to the country’s growth and debt outlook. Fitch expects the Indian economy to contract by 5% in FY2021 before rebounding by 9.5% in FY2022, mainly driven by a low-base effect.

Indian equity markets have bounced in line with global markets. High-Frequency Indicators (HFI) have shown activity levels bouncing up strongly in June’20, albeit still below pre-COVID levels. 1Q earnings will be expectedly tough and investors will keenly watch management commentaries to gauge what the post-COVID ‘normal’ looks like. Being overweight on segments where FY22 EPS could exceed FY20 EPS could emerge as an attractive investment theme. The key is to stay invested and participate in the recovery which will unfold in the future.

On the debt market side, RBI reduced the repo rate by 40 bps to 4% and consequently, reverse repo rate was reduced to 3.35% in May 2020. The MPC retained its accommodative stance, and this stance will continue till growth revives (while ensuring that inflation remains within the target). The RBI also extended the moratorium on term loans and interest on working capital loans by 3 months, improving the cash flow of companies. After MPC’s acknowledgement of negative GDP growth in the coming year (FY21), analysts expect additional rate cuts of at least 25-35 bps. AAA Corporate Bond yield rallied with spreads compressing more at the shorter end. The spreads over Government Securities (G-secs) are still at elevated levels and this provides an opportunity to create a portfolio with higher exposure towards AAA corporate bonds and money market instruments with low to moderate duration – delivering favourable risk-adjusted returns in AAA Corporate Bond space.

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/