Starting with the U.S.: Low interest rates for the next 2-3 years.

The Federal Open Market Committee (FOMC) in its meeting in September signalled that the Fed will keep key interest rates near zero through 2023 – an addition of one more year to the previous guidance. The Fed will also continue to purchase $120 billion worth of Treasuries and mortgage-backed securities each month. The U.S. Federal Government has an annual $3+ trillion deficit and with U.S. Treasury debt looking at crossing 100% of annual GDP, key interest rates will remain low.

The economic data for the quarter has been mixed to positive. On the positive side, the Labor Department reported that the unemployment rate declined from 10.2% in July to 8.4% in August. 1.73 million payroll jobs were created in July and a further 1.37 million in August. Labor force participation rate rose from 61.4% in July to 61.7% in August. The Labor Department also reported that unemployment claims (excluding seasonal adjustments) were significantly lower, at 833,352. The Institute of Supply Management (ISM) reported that its manufacturing index rose to 56 in August, an increase from the 54.2 level of July.

On the flip side, as of August, the U.S. trade deficit stood at $67.1 billion, up from $63.4 billion in July. Imports rose 3.2% to $239 billion, while exports only climbed by 2.2%. Imports at 3% below pre-pandemic levels indicate a rebound in consumption, but exports at 18% lower imply domestic manufacturing is still lagging. The US is a consumption driven economy and exports would increase when global trade picks up / a more sustainable global opening.

Consumers account for approximately 65% of the U.S. economy and it is important to track consumer consumption and saving numbers. August 2020 retail sales rose 0.6% – lower than the 0.9% of July. The more striking indicator was U.S. personal savings which was c. 24% in August 2020 – this number was c. 8% in August 2019. COVID is resulting in accumulation of cash across all income groups. These indicators will become increasingly important to monitor, especially once a vaccine is available: are we seeing a structural change in spending habits or will things reverse to pre-pandemic patterns? There is a huge difference between 8% savings and 24% savings – consumers may not move to 8%, but the movement towards 8% should result in major economic activity.

Moving on to Europe: UK’s race to zero and even negative interest rates is on.

In its September meeting, the Bank of England (BoE) voted unanimously to maintain Bank Rate at a record low of 0.1% and the size of its bond-buying program at £745 billion. More significantly, the monetary policy committee (MPC) said it was seeking to overcome obstacles to enable negative interest rates i.e. further cuts from the current 0.1% base rate. This move would bring the BoE in line with the European Central Bank and the Bank of Japan.

In its September meeting, the ECB kept its main refinancing rate unchanged at 0% and pledged to buy up to €1.35 trillion worth of debt through June 2021 under its Pandemic Emergency Purchase Programme. Interest rates on the marginal lending facility and the deposit facility were kept steady at 0.25% and -0.50% respectively. Euro Area real GDP is only expected to recover to pre-crisis levels in late 2022.

China: First to be hit…and the first to recover.

With the absence of a government funded safety net, China has always had a high personal savings rate. Household consumption in 2019 was 39% of GDP – low when compared to a global average of 63%. During lockdown only 3% of the total 80 million unemployed Chinese workers received benefits. China hence focussed on enforcing strict protocols targeted towards re-opening factories. China has recently lowered the upper limit on legally protected interest rates to a new cap of 15.4%. While this does not augment favourably for private lenders, this will help direct funds back to institutional lenders and expand their capability to extend cheap financing to MSMEs.

The result of the above has been that China is expected to show growth for 2020 – while the third quarter numbers are yet to be released, this could be as high as 5% compared to 2019. The recovery is commendable because it is not being led by consumer spending, but rather by industrial production.

Closer home in India: Markets showing a broad-based recovery.

As witnessed at the close of last quarter, the economy continued to show signs of improvement, albeit slowly and in pockets. This has been led by a series of unlocking measures being unveiled by the central and state governments. India transitioned in the quarter from localized lockdowns to the widespread opening up with very few sectors now under restriction ahead of the festive season. Pent-up demand and inventory filling ahead of the festive season have also helped the underlying recovery:

- September Manufacturing PMI accelerated to 56.8 vs 52.0 in August to reach the highest in over eight years.

- Services PMI also saw significant improvement at 49.8 Vs 8 in August.

- Steel production continues to improve given the improved exports and demand recovery in domestic markets whilst cement demand was subdued from higher monsoons.

- Both urban and rural unemployment has improved to above pre-COVID levels. Rural India has been relatively less impacted by the lockdown and has been the silver lining.

- Two wheeler growth is supported by both rural and urban demand.

- Tractor sales continue their healthy growth.

The government passed key agriculture reforms to deregulate agriculture commodities and liberalize agriculture marketing. The government has now deregulated key commodities (including cereals, edible oils, oilseeds, pulses, onions and potatoes). The Central government has introduced legislation to enable adequate choice for farmers to sell their produce and allow barrier-free interstate trade in agriculture commodities. Currently, farmers are bound by a monopsony[1]. The government has also introduced legislation that provides for a farming agreement between farmers and buyers before the production or rearing of any farm produce.

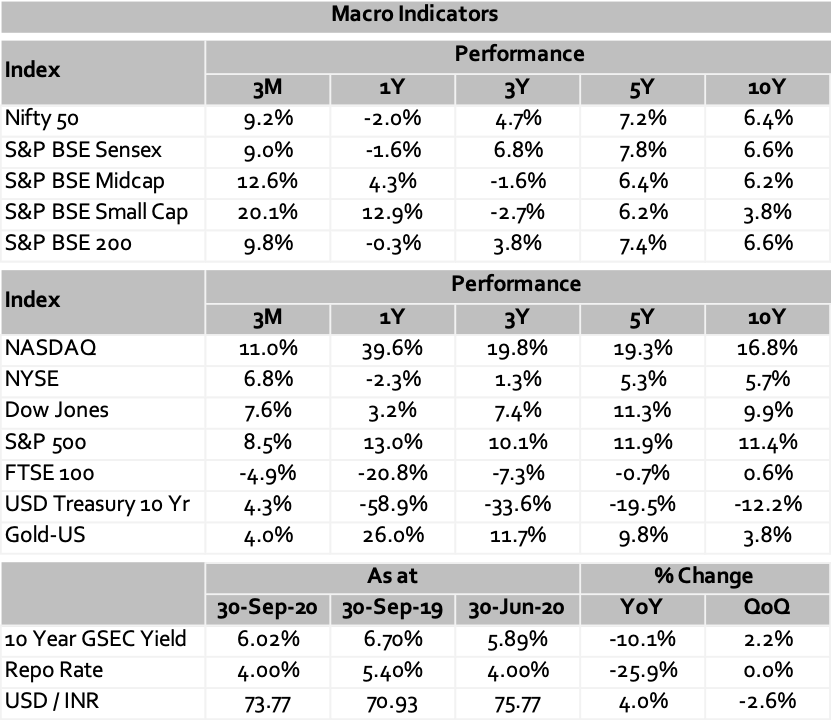

Indian equity markets have shown good bounce in anticipation of a recovery. The markets have been broad-based with broader markets outperforming the Nifty 50, first time after 2 years. After the trough seen in the June quarter, earnings estimates for FY22 across sectors have seen upgrades.

Bonds remained range-bound although with a slightly bearish bias due to the consecutive devolvement of the benchmark paper in the weekly auctions. The 10-year benchmark yield which touched an intra-month of 6.06% ended the month at 6.01% on secondary market buying by RBI. India’s external account is very strong and provides an adequate cushion to RBI to persist with a dovish policy. The new Monetary Policy Committee (MPC) voted for rates to remain unchanged and maintained the ‘accommodative’ stance.

[1] In economics, a monopsony is a market structure in which a single buyer substantially controls the market as the major purchaser of goods and services offered by many would-be sellers. (Wikipedia)

——————————————————————————————————————–

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/

——————————————————————————————————————–