2021: First Quarter Wrap

Our 2020 Last Quarter wrap suggested a mantra for 2021: “don’t chase the market – let it come to you”. The volatility experienced by investors in the first quarter of 2021 gave plenty of heartburn, but also great investment opportunities for those who patiently bought at dips. We expect this trend to continue for the rest of the year… but do hope the volatility subsides in the 2nd quarter of 2021. The third quarter is seasonally volatile and the last quarter historically the strongest. Investors should be prepared for a bumpy ride.

Starting with the US: The Fed believes inflation is “transitionary”

Economic data in February – both new and existing home sales, and retail sales were below expectations. The Commerce Department reported that retail sales dipped 3% in February whilst also revising the January number to show a 7.6% increase (an impact of the $600 stimulus check). A lot of the poor February data was driven by a severe winter and global container shortages. Notwithstanding the above, the U.S. will still lead global economic recovery in 2021. The Atlanta Fed revised its first-quarter GDP estimate to 5.4% p.a. and retail sales are expected to see a significant uptick with the Biden stimulus package.

The Federal Open Market Committee (FOMC) reiterated that key short-term interest rates would remain at 0% through 2023 and that the Fed would continue buying $120 billion per month in both Treasury and mortgage-backed securities. The Fed also raised its 2021 inflation target to 2.4% (up from its previous estimate of 1.8% back in December). The FOMC expects inflation to ease to 2% in 2022 and 2.1% in 2023. On the flip side the 10-year Treasury bond yield continued to rise (putting doubts on the ability of the Fed to manage long term rates) and the federal budget deficit crossed a staggering $28 trillion.

With earnings growth at 3.9%, FactSet reported that 79% of S&P 500 companies topped analysts’ earnings estimates for the fourth quarter. Despite the positive results information flow in January and February, the NASDAQ pulled back from all-time highs in mid-February and slipped almost 10% over the next 30 days. However, by the end of March NASDAQ rebounded about 6.5%. So, while the NASDAQ, S&P 500 and Dow oscillated all of March, importantly all three indices closed out March on a strong note. As per FactSet, the S&P 500’s first-quarter earnings are now expected to grow at c. 24% on a year to year basis (compared to previous forecast of c. 15%).

Europe: A Double-dip recession

With another wave of Covid cases, both large and small European economies including France, Italy and Poland have put in place lockdown restrictions again. These restrictions are putting severe stress on an already struggling economic zone and Europe is in the midst of a double-dip recession. GDP in the Eurozone declined 6.9% in 2020, with the first quarter of 2021 seeing a further dip of 0.7% and the second quarter forecasted to dip another 0.8%. The UK did not fare any better with a c. 8% contraction in GDP growth in 2020.

China: Ready to fire on all cylinders

China is expected to achieve 6% GDP growth in 2021. Fiscal support for the economy is being cut as the government has reduced its deficit-to GDP target to 3.2% (from the previous 3.6%). New jobs for 2021 target has been revised upwards from 9 million previously to 11 million and targeted consumer inflation reduced form previously 3.5% to 3%. The biggest indicator that the growth is sustainable is that the government will no longer issue any Covid Bonds.

With starting up of factories in China (and other parts of the world) there is an increase in shipping tariffs. Further, the fragmented opening up of the global economy is also causing non availability of containers. With China getting back on track, there is a possibility of emergence of a commodity super cycle.

Closer home in India: Economy recovers and is on growth path; RBI reaffirms accommodative stance

The economy is believed to be at an inflexion point, led by a supportive policy mix with strengthening domestic and external demand, which should revive private capex. The Economic Survey expects India’s real GDP growth at 11% in FY2022 (nominal GDP growth of 15.4%) after a fall of 7.7%. Tax collections have been robust and indicate that a revival is underway. A strong revival as such would have a lasting rub-off effect on the economy for years to come. The key risks to equity markets are any sharp increase in US bond yields and/or outflow of FII / FDI monies from India.

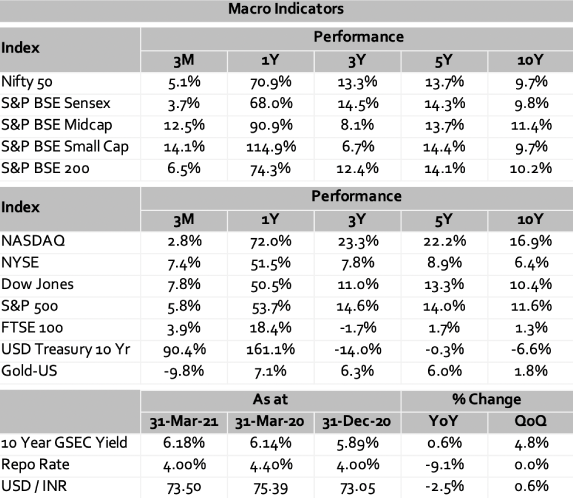

Nifty-50 and Sensex closed the last quarter of FY21 with gains of 5.1% and 3.7%, respectively. Midcap and small-cap index outperformed the Nifty-50 by a good margin as Q3 FY21 GDP recorded a growth of 0.4% after two quarters of contraction. From a macro perspective, benign interest rates, ample liquidity and a growth focus (rather than inflation control) as the fulcrum of the Central bank policy are all positives for equities. However the recent rapid spurt in Covid-19 cases, possible imposition of lockdowns, night curfews and other restrictions, elevated crude prices and jump in bond yields are once again weighing down sentiments. Covid-19 led disruptions may continue to pull down the market in the coming quarter.

On the debt market side, bond yields stabilised by the end of Mar 2021 after sharp increases in the earlier part of the quarter. February CPI inflation rose to 5.03% in Feb 2021 amid increasing momentum and adverse base effects. The pick-up in inflation despite stable food prices highlights the challenges to the inflation outlook amid rising commodity and oil prices. While inflation should broadly remain within the RBI’s target band and provide comfort to the RBI to retain its accommodative stance, demand-side pressures are likely to keep core inflation elevated.

As widely expected, the RBI in its April’21 policy kept all rates on hold. The RBI reaffirmed the guidance of accommodative stance till prospects for a sustained recovery are well secured and further announced a new secondary market government bond acquisition program termed G-SAP 1.0 where it committed to purchase a specific amount of government bonds (pegged at INR 1 lakh crores for Q1 FY22), which is loosely touted to be India’s QE and is cooling off the yields.

——————————————————————————————————————–

——————————————————————————————————————–

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/

——————————————————————————————————————–