The second quarter has been an extraordinary quarter for global equities – fuelled by low interest rates and continued quantitative easing across the US and Europe and the world learning to live with Covid.

Central banks revisited acceptable inflation numbers and signalled their comfort with a higher benchmark. Investors are now faced with the prospect of long term zero or perhaps even negative interest rates. Global economies are going through a structural change.

Starting with the US: Accommodative, and still more accommodative

The quarter saw inflation rising with the Producer Price Index “PPI” at 7.3%, Consumer Price Index “CPI” at 5.4% (the highest since August 2008) and Core CPI (excluding food and energy) running at 3.8% (highest since June 1992) for the past 12 months. The key thing to note is that 60% of PPI inflation was on account of services (where costs normally do not decrease). Inflation runs the risk of being sticky and not transitionary. GDP estimates have been trimmed to 7.8% for the second quarter down from the previous estimate of 8.6% as the gap in trade of goods and services rose 3.1% to $71.2 billion in May (from a revised $69.1 billion in April).

In June 2021, the labour department reported fewer job creation. Since the pandemic, 7 million jobs have not been restored and while part of this could be due to people deciding to retire, labour shortage is being witnessed in the lower paying jobs. US service providers (a measure of employment) expanded in June by less than forecast, reflecting employers’ struggle to attract workers. The US Fed has made it clear that its top priority is “employment” and therefore support to business will continue. The US budget deficit is expected to reach $30 trillion and the Fed continues to buy $120 billion in Treasury bonds every month. During the April Federal Open Market Committee (FOMC) meeting the current near-zero interest rate policy and the bond-buying program was maintained. Not surprisingly, the 10-year Treasury bond yields fell below 1.5% and continue to drop.

Interestingly, there is strong demand for corporate bonds: corporate and treasury bonds spreads are at an all-time low. There could be 2 drivers for this (a) interest rates are going to eventually be negative and everyone wants yield while still available and/or (b) companies are looking to refinance existing debt and gather cash to buy back stocks. More than $500 billion in stock buybacks have been authorized in 2021 – the fastest pace of stock buybacks in last 2 years (buybacks boost ROE and EPS).

Big Tech continues to drive buybacks. Apple repurchased around $19 billion of stock in the March quarter (total for the past four quarters was $77 billion), Google parent Alphabet repurchased $11.4 billion (up from $8.5 billion a year earlier), Facebook bought back $3.9 billion (triple the total a year ago and Microsoft bought back about $7 billion of stock ($20 billion in the first nine months of its fiscal year ending in June).

More than 80% of the S&P500 Companies exceeded analysts’ first quarter earnings estimates. The pace of the earnings was the fastest in more than a decade, growing at c. 50% pace. Second quarter earnings are expected to grow at a faster pace than the first quarter estimating the earnings to grow year-over-year at a rate of c. 60%.

Europe: Higher levels of acceptable inflation

The European Central Bank (ECB) announced that it would tolerate up to 2% annual inflation. It also stated it would buy bonds at a “significantly higher” pace than during the early months of 2021 i.e. no chance on tapering the 1.85 trillion euro Pandemic Emergency Purchase Program. 2021 growth is now projected at 4.6% (higher than the 4% projected in March) and 2022 growth forecast is increased to 4.7% (from 4.1%). Zero to negative interest rates, higher tolerance for inflation and continued liquidity all resulted in a strong bounce back in European equities for the quarter.

China: A market at risk

Chinese exports grew 32% in June while imports increased 36% year on year. While these numbers benefit from a low base of the previous year, businesses continue to perform. On the flip side, the Chinese financial system is operating on significant leverage and this exposes it to risk. An economic downturn, coupled with a real estate and stock market correction would be deflationary. The warning signs are evident from the price of key commodities like iron ore and copper. China is the largest consumer of commodities and trade relationships with the rest of Asia are as important as those with the U.S. Fragility of commodity-based currencies like the Australian and Canadian Dollar and the Brazilian Real additionally impose unwanted external threats.

Any investment strategy for China must provide for quick exits as the Chinese stock market currently is not ideal for long term investors. For those already invested, it may be prudent to take some risk off the table.

Closer home in India: Markets continue their rise with the receding of the third wave

Last quarter, India has gone through a fierce wave of Covid-19. Notwithstanding, Q1 FY22 results are expected to show strong year on year growth across all sectors due to weak numbers in the base quarter (Q1 FY21). GDP growth expectations have now been toned down to 9-10% in FY22.

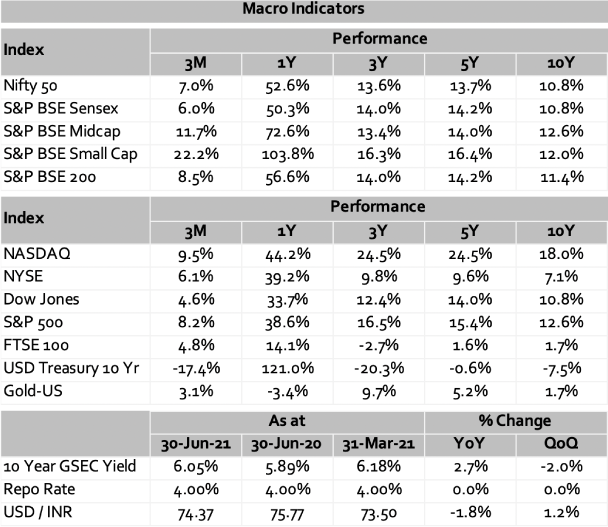

Headline indices rose to lifetime highs in June 2021 despite several hiccups during the month. Strong flows from retail investors and declining COVID-19 cases have offset the pessimism led by US Fed’s signals of two rate hikes before 2023 end. Whilst, Nifty-50 gained 7%, in Q1 FY22, Midcap and small-cap rallied with 11.7 % and 22.2% respectively. Valuations are high but liquidity in global markets and expected increase in earnings are holding the market. Any unknown risk can lead to a swift correction given the historically high valuations across sectors.

As widely expected, the Monetary Policy Committee (MPC) kept key rates unchanged and reiterated its commitment to an accommodative stance as long as necessary to revive and sustain growth on a durable basis. The MPC also made it a point to address inflation concerns reassuring the markets that it has not taken its eye off inflation figures. It is clear from the bond auctions that RBI would like 10 Year G-Sec to be below 6%, but traders want a higher yield. We see the rates hovering between 6.0% – 6.3%.

———————————————————————————————————————————————————————————————————————————————————————————-

—————————————————————————————————————————————————————————————————————————————————————————————-

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/

—————————————————————————————————————————————————————————————————————————————————————————————