What a volatile year this is turning out to be. Investors across the major financial asset classes: fixed income, equities and commodities have their work cut out.

What a volatile year this is turning out to be. Investors across the major financial asset classes: fixed income, equities and commodities have their work cut out.

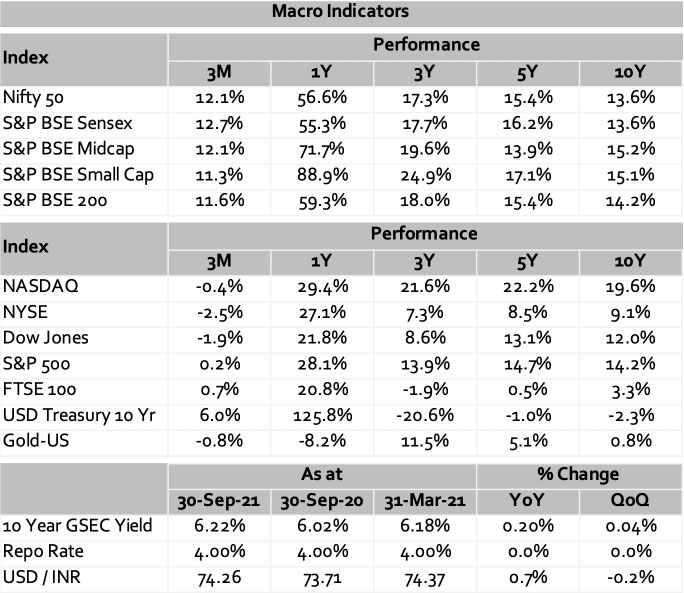

On the macro front, a lack of consensus on the nature of inflation i.e. transitionary or structural has participants guessing the timing of (1) pullback of quantitative easing and (2) increase in interest rates. On a micro-level supply chain disruptions which were impacting the availability of raw materials have now impacted global shipping; and the ongoing energy crisis isn’t helping either.

Starting with the US: Rising inflation coupled with a slowdown in growth

The Federal Reserve (Fed) has reduced its third-quarter GDP growth estimate from 2.3% to 1.3% – the slowdown is primarily driven by weak home sales and supply chain (port) disruptions. The quarter also saw inflation rising above the Federal Reserve’s 2% threshold to 2.3%. The Personal Consumption Expenditures (PCE) price index is an inflationary indicator and while it rose 0.3% in August (in line with the estimates), for the full year it is expected at 4.2%.

On a positive note, the Producer Price Index (PPI) climbed 7.8% year-over-year (estimates was 7.3%). Unemployment is at 4.8%: 568,000 private jobs were added in September (estimates was 425,000) and jobless claims also saw a reduction to 326,000.

On the back of rising inflation and a massive federal budget deficit of USD29trillion, the Fed finally stated that it intends to start “tapering” its bond-buying program of USD 120bn per month. The Federal Open Market Committee (FOMC) meeting revealed that half of FOMC members now anticipate at least one rate hike by the end of 2022 and more are expected in 2023. Uncertainty on timing has resulted in volatility in the bond market and August saw the 10-year treasury yield breach 1.2%.

Ultra-low yields have resulted in capital pouring into the stock market: “the search of higher yields” – the Dow today has a c. 2.3% dividend yield and with Europe firmly at negative interest rates, equity markets remain attractive. For the third quarter, FactSet expects the S&P 500 to average 27.6% earnings growth and 14.9% revenue growth. Fourth-quarter estimates remain solid, with FactSet anticipating 21.5% average earnings growth and 11.4% average revenue growth.

The budget deficit ceiling and the infrastructure bill remain a matter of contention. Notwithstanding the political posturing, it is likely that the deficit ceiling will be lifted before October 18. On the second matter – the infrastructure bill does not have such an optimistic outlook and is unlikely to get passed (unless there is a massive reduction in outlay/spending). This however also implies that taxes would not go up to the levels expected – a bullish scenario for equity investors.

Europe: Finally time for tapering

The European Central Bank (ECB) has been continuing with its Pandemic Emergency Purchase Program (PEPP) of c. EUR1.8 trillion. Similar to the Fed, in early September the ECB stated that it will continue to purchase bonds, albeit at a “moderately lower pace of purchase” i.e. lower than the Euro80bn per month purchased over the last 2 quarters .

Unlike the Fed, raising interest rates by the ECB may be more difficult given the budget deficit of Eurozone countries. The ECB also has a greater tolerance to inflation and will maintain its current (-0.5%) interest rate policy. For 2021 the ECB expects 2.2% inflation and 1.3% core inflation and for 2022, inflation at 1.7% and core inflation at 1.4%. The ECB declared it would not change interest rates until inflation reaches a 2% annual rate.

China: A faltering recovery with fears of a slowdown in the second half

Fixed asset investment from January – August 2021 rose 8.9% from a year ago. While this was good, industrial production growth in August was below expectations at 5.3% (estimated at 5.8). Most parts of China were under travel restrictions and local lockdowns for a major part of the summer holidays. Retail sales which were expected to return to pre-COVID growth were negatively impacted during this period.

To make things worse, China’s recent power crisis has resulted in more than half of the country (16 of 31 provincial-level jurisdictions) enduring power cuts (one of the most extreme examples of energy rationing in its history). Different places have different reasons: the south mainly due to the lack of coal, some regions due to local governments’ restriction on the capacity of high energy-consuming industries and some regions storing coal for the winter.

A small note on Evergrande for our readers: Evergrande is one of China’s biggest companies with borrowings of more than $300bn. Evergrande Group’s liquidity crunch is stoking concerns that other developers may also feel the squeeze from higher borrowing costs (lenders have turned more cautious). Companies that do business with Evergrande – construction and design firms and materials suppliers are at risk of incurring major losses. The impact on the financial services sector (while currently contained) could also be material – Evergrande reportedly owes money to around 171 domestic banks and 121 other financial firms. A failure at Evergrande could shave between 1%-2% of China GDP growth.

Closer home in India: Earnings show resilience but rising inflation risks a market correction

Indian markets continued their bull-run, with Nifty rising 12% last quarter and closing above 17,500 levels at the month-end. Record low-interest rates, government reform/relief measures (telecoms, autos and banks), improved vaccine access and subsequent pick-up in service sector activity kept the momentum strong. Equity markets have witnessed quite a comeback during the last 15 months and valuations (basis historic earnings) for the leading indices “optically” seem to be at a premium to long-term averages. However, adjusted earnings for a normalized 12-month forward and factoring the lower cost of capital, valuations are either in-line with long-term averages or at a mild premium.

The primary markets, on the other hand, continue to be vibrant as many new-age businesses get listed offering investors an opportunity to participate in their growth journey. Companies have raised $10.8 billion from first-time share sales this year, according to data compiled by Bloomberg. At this pace, 2021 could well surpass the record $11.8 billion mopped up in 2017.

There is buoyancy all around with the earnings growth showing strong growth and resilience in the coming quarters. Channel check suggests that economic buoyancy even in Tier 2 and Tier 3 towns. The only thing not in favour is supply chain shocks and resulting inflation risk. The Central Bank kept the key interest rates unchanged and has set out a glide path for withdrawing liquidity in a gradual and calibrated manner. The withdrawal liquidity is likely to put downward pressure on inflation but crude price rise remains India’s biggest economic risk.

Broadly, India is well-positioned to commence on a new economic upcycle over the next few years, which can mean broad-based improvement across a variety of industries.

———————————————————————————————————————————————————————————————————————————————————————————-

—————————————————————————————————————————————————————————————————————————————————————————————-

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/

—————————————————————————————————————————————————————————————————————————————————————————————