While the first quarter of 2022 was characterised by uncertainty, the second quarter saw a lot of the concerns fructify. The eye-opener for a lot of investors has been the speed at which regulators, markets and asset classes have acted during this tough economic environment.

Some regulators have been quick and some it can be said have been or are still slow to act. The US markets have demonstrated that they are remarkably quick to price economic news data while others are not so efficient – there are pockets where price corrections are still to happen.

Starting with the US: Inflation is raging, but it may have peaked

In an attempt to tame record-high inflation, the US Fed did a a 0.5% interest rate hike in May followed by a 0.75% hike in June. The hawkish tone deployed in the June FOMC points to another 0.75%-1.0% hike in July and another similar hike in September. Interestingly the Bank of Canada in a surprise move raised its main interest rate by 1%, becoming the first G7 country to make such an aggressive hike in this economic cycle.

U.S. consumer price index (CPI) rose by 9.1% year on year in June exceeding estimates of 8.8% – another month of the fastest pace for inflation in the past 40 years. The Core CPI, which excludes food and energy prices edged lower to 5.9% in the same period from 6% but still surpassed analysts’ forecast of 5.8%. Monthly core CPI was up 0.7% and headline CPI rose 1.3%, which was itself the biggest monthly gain since 2005. CPI increase was largely due to increases in prices of food, gasoline and shelter.

Wholesale inflation did not fare any better with the Producer Price Index (PPI) surging to an 11.3% annual pace in June. On a month-to-month basis, PPI rose 1.1%, which was higher than expectations of 0.8%. The jump in PPI was driven by energy costs with gasoline costs climbing 18.5% in June (54% in the past 12 months). Excluding energy, food and trade services core PPI increased 0.3% in June, up 6.4% year-over-year. The US manufacturing sector expanded at a much softer pace in June than it did in May with the ISM Manufacturing PMI dropping to 53 from 56.1 (weaker than the market expectation of 54.9). The IMF has cut US 2022 GDP growth projection to 2.3% from 2.9%.

On the positive side, U.S. employers added more jobs in June than forecast and the unemployment rate at 3.6% is near a five-decade low. The Retail Sales report was also better than expected. Sales were up 1% in June while May was revised down to -0.1% (previously +0.3%). Interestingly bars and restaurants sales were up 1% and given this is discretionary spending this cools down some of the recessionary fears. The last 12 months have now seen retail sales increase 8.4%. Another interesting data point is that with increased production, the US is now energy independent. Demand has dropped and the US has a surplus and is now exporting refined oil i.e. trade deficit numbers are declining. The Atlanta fed has put the 2nd quarter GDP estimate at -0.12% giving hope to the theory that the recession could be a shallow one.

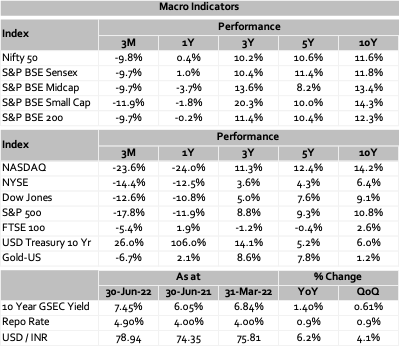

A brutal start to the year for markets only got worse. The S&P 500 closed out the first half of the year down nearly 21%, the steepest first-half loss seen in more than five decades, leaving the benchmark index firmly in bear market territory. The growth-heavy Nasdaq 100 declined in five of the first six months this year which marked both its worst first half (-30%) in 20 years (Q2 2002) and its worst quarter (-22% in Q2) since Q4 2008.

Rate-sensitive growth stocks are under pressure from the benchmark U.S. 10-year Treasury yield, which climbed as much as 3.5% to its highest level in 11 years but dipped below 3% at the closing of 2nd quarter. The jump in rates came after the 2-year and 10-year Treasury yield curve briefly inverted for the first time since early April. Summing up the sell-off in risky assets, the once red-hot crypto market has also cooled. The price of Bitcoin (BTC) has plummeted nearly 60% this year, while Ethereum (ETH) is down more than 70%. Even gold, long considered a safe-haven asset, is down more than 4% year to date.

Pockets of investors feel that uncertanity has been priced and the worst may be over. It is important to remember that the world is adjusting from decade long zero rates and a lot of unwinding may still be seen. A cautious appoach is warranted.

Europe: No end to inflation

Europe inflation hit a new record high of 8.6% in June, beating the 8.1% recorded in May. Skyrocketing gas prices and food grain shortage have been the key drivers. The European Central Bank (ECB) expects inflation to remain “undesirably” high for the next couple of years: 6.8% in 2022, 3.5% in 2023 and 2.1% in 2024.The surge in the prices prompted the ECB to raise rates for the first time in 11 years. The ECB has also validated another hike in September which might be larger than the first hike of 25 bps, meaning its main interest rate could turn to positive territory this year – the ECB has had negative rates since 2014.

Real GDP growth in both the EU and the Euro area is now expected at 2.7% in 2022 and 2.3% in 2023, down from 4.0% and 2.8%. Germany’s central bank lowered its 2022 GDP growth forecast to 1.9% from its previous projection of 4.2% in December last year. With gas prices soaring and the Ukraine war showing no signs of easing off, the euro has lost over 9% of its value against the dollar since the start of the year. It continues its slide towards dollar parity and may even fall into the $0.95-0.97 range.

Europe is in recession and in a tough place. The member economies are struggling with food and energy disruptions and an increase in rates hits the Eurozone even harder. Rationing of natural gas, distress in the German chemical industry and more recently the Italian political crisis are signs of a tough period with little respite in sight.

China: The zero covid policy starting to take a toll

China’s economy contracted sharply in the second quarter with growth plunging to 0.4%, the lowest in two years. The economy was hit hard by the zero-COVID policy that led to prolonged lockdowns in top cities and damaged businesses and industrial supply chains.

Consumer price index (CPI) increased 2.5% from a year earlier, widening from the 2.1% gain in May and the highest in 23 months. Core consumer inflation rate, excluding the prices of food and energy, rose by 1% in June compared with a year earlier, up 0.1% from a rise of 0.9% in May. The world’s second-largest economy has largely been spared the impact of a global surge in food prices caused by Russia’s war in Ukraine, but the relative stability could be upended by the rising cost of pork, a staple meat in the country.

On the positive side, manufacturing and service industries saw their first month of growth since February as Covid restrictions were eased in many cities. The purchasing managers’ index (PMI) rose to 50.2 in June, the first time it has crossed the 50 mark since February. China H1 trade also posted resilient growth of 9.4%. China’s Ministry of Finance is considering allowing local governments to sell 1.5 trillion yuan ($220 billion) of special bonds in the second half, an unprecedented acceleration of infrastructure funding aimed at shoring up the economy and achieving its annual growth target of around 5.5%.

Closer home to India: The worsening had stalled and green shoots emerge

China’s consumer price index (CPI) rose 1.5% year on year in March, driven by the rising cost of global commodities as well as epidemic outbreaks. Food prices fell by 1.5% year on year in March, compared with a drop of 3.9% in February, contributing to a 0.28% decline in the CPI. On the jobs report side, the country’s overall unemployment rate remains stable, fluctuating between 5% and 5.5% in recent months.

In the final month of the quarter, China’s manufacturing activity slumped to a two-year low due to disruptions caused by tech hub Shenzhen (which oversees roughly half of all China’s online retail exporters) going under a one-week lockdown, as well as cancelled export orders amid the uncertainty from Russia’s invasion of Ukraine. A spate of lockdowns in Shanghai and other Chinese cities is piling severe pressure on transport and logistics across the country, exacerbating the economic fallout of the government’s commitment to its zero-Covid policies as cases continue to soar to record levels. Chinese export growth slowed to an annual 15% in March, from 16% in January and February combined.

Yields on China’s 10-year government bonds fell below US Treasury yields for the first time in 12 years on expectations of more Chinese monetary easing. This will further sharpen the divergence in policy from the major global economies of the United States and Europe.

Closer home in India: Similar to last quarter the year begins on a flattish note

Equity markets fell this quarter with the Nifty 50 closing down by 9.8% and the Small-cap index closing down by 11.9%. Valuations have corrected and are now in line with historical averages. Explosive earnings growth off a low base is now over and analysts expect mid-teens growth over the next 2 years. Indian markets may be spared a deeper correction like global markets as corporate and financial balance sheets are healthy with the lowest Debt/EBITDA since 2009 and ROE crossing 15% for the first time since 2012.

Early in June, the MPC voted to hike the repo rate by 50bps to 4.9% in line with consensus. The MPC made a minor adjustment by omitting the word ‘accommodative’, while it continues to prioritize inflation over growth. Headline CPI inflation in June eased marginally to 7.01%. The mild moderation in June CPI inflation was led by moderation in food and core inflation. While inflation has declined for the second straight month, analysts expect it to hover around the 6.5% mark for FY23. The recent moderation in commodity prices led by recessionary concerns provides some relief, but the weakening INR is expected to limit the cheer.

The RBI recently announced measures to attract forex flows through the banks, corporates, and debt investors signalling a stronger intent in addressing the current dollar shortage and control the INR fall against the USD. Last time such measures were taken the world was a different place. A close monitoring of the impact on the forex exchange rate caused by these measures by RBI needs to me monitored. Forex reserves remain at a healthy level and incremental flows from the measures are aimed at bolstering it further. Given the uncertainty in the global macro environment INR is likely to remain under pressure, especially if crude prices remain elevated and global growth slows down. A widening CAD coupled with capital outflows will keep the INR on a depreciating bias punctuated by RBI’s forex intervention.

—————————————————————————————————————————————————————————————————————————————————————————————-

Our in-house views and analysis on developments – both macro and micro:

www.valtrustcapital.com/thoughtseries/